The Pomp Letter (private feed for doczok@zoho.com)

https://api.substack.com/feed/podcast/1383/private/db96a709-b2c2-4226-af09-d32883859066.rssEpisode List

Risk Assets and Safe Haven Assets Push Higher Together?!

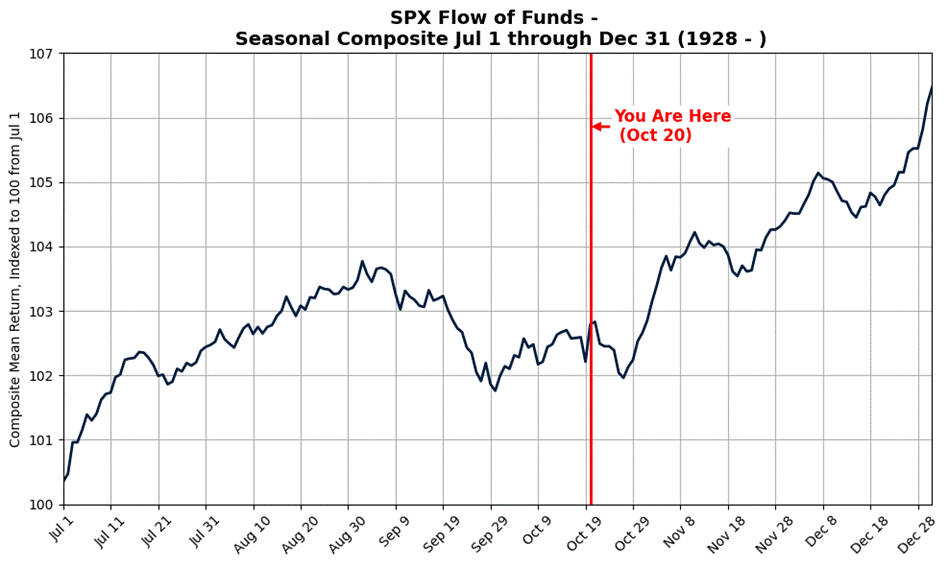

Today’s Letter is brought to you by Arch Public!Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.Talk to us today and discover why our expertise sets us apart.To Investors,Peter Lynch is one of the greatest investors to ever live. While at Fidelity Investments, he averaged a 29% return and managed the best performing mutual fund in the world. So it is noteworthy that one of his most famous quotes is “if you spend 13 minutes a year on economics, you have wasted 10 minutes.”Pretty good one-liner, right?The reason Lynch believed macro economics was noise is because he managed money during a time where everyone was constantly worried about monetary policy, geopolitics, and various topics outside financial markets. His strategy was simply to buy shares in great companies and wait for the companies to increase in value.It wasn’t rocket science. But here is the thing, the stock market has significantly changed over the last 50 years. We went from a market where ignoring macro economics increased your likelihood of success to the modern market where paying attention to macro economics is all that matters.Let me give you an example. Former Pimco CEO Mohammed El-Erian wrote yesterday “Forgive me for sounding like a broken record, but today’s market action is so illustrative of something I’ve been trying to convey for a while now. The notable thing about gold today isn’t just that its price hit yet another record high, but how it has done so: Gold is surging on the same day that US stock indices have over 1%. This simultaneous climb in both a classic safe haven and risk assets is a powerful illustration that the drivers of the current gold rally are different from historical patterns.”Safe haven assets and risk assets are both pushing higher at the same time. That isn’t supposed to happen. It violates everything an investor was taught in their Economics 101 class. So what is going on here?Holger Zschaepitz explains the different sides of the debate:“Despite the Nasdaq 100 hitting a new all-time high, market sentiment remains unusually split, a divide also reflected in Bitcoin’s wild swings. Goldman Sachs sees two ways to read this: Cynics view it as a fragile equilibrium, where even a small shock could end the rally. Optimists see it as the hallmark of a healthy bull market – one that keeps climbing the proverbial wall of worry.”So who is right? Should we be worried about the concurrent rise of risk assets and safe haven assets? Well, let’s turn back to Peter Lynch.He once said “I’ve studied the Constitution and the Bill of Rights, and I don’t see anywhere that we have to have a recession every four years. I don’t see why you can’t have a decent environment for years and years.”Spoken like a true optimist if you ask me.My personal opinion on why all asset prices are going higher boils down to the macro environment. Markets are forward-looking and everyone has become convinced that the government won’t stop printing money, the national debt is going to continue accelerating higher, the Federal Reserve and central banks around the world have to cut interest rates in the coming months, and artificial intelligence is making companies more profitable with less employees.Those four factors are causing investors to pour capital into almost all asset classes. They understand holding cash and bonds will likely be a losing trade. You can buy stocks, bitcoin, gold, real estate, or collectibles. The micro decisions are not nearly as important as the big decision to convert fiat dollars into some kind of investment asset.People are not going to wait around for the currency debasement and persistently high inflation to wreck their portfolio. They are positioning themselves to benefit from the pain on the horizon.Add in the fact that we are sitting in the middle of October, which means the year end chase is underway, and it becomes obvious that the bull market is not ending this month.Risk assets and safe haven assets are going to continue performing. In this environment, some investors want to play offense and some want to play defense. But the number of market participants has expanded so rapidly that now there is enough capital for both types of assets to appreciate as money sloshes around the system.Price appreciation won’t be a straight line to the sky. There will be corrections along the way. But as Peter Lynch advised us, “in the stock market, the most important organ is the stomach. It’s not the brain.” So keep your head on a swivel and understand the macro environment went from something you could ignore in the past to potentially the only thing that matters today.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementThis Executive Thinks Bitcoin Will Hit $180,000 By Year EndChris Klein is the Co-Founder & CEO of Bitcoin IRA (https://bitcoinira.com/pomp/). In this conversation, we discuss how retirement investing is changing in the digital era, what people are actually doing inside their retirement accounts, and how the wealthy use these tools to grow their wealth faster. We also dive into broader topics like patriotism in America, macro trends, and the roles of gold, silver, stocks, and Bitcoin in today’s economy.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Is The Great Rotation From Gold to Bitcoin Upon Us?

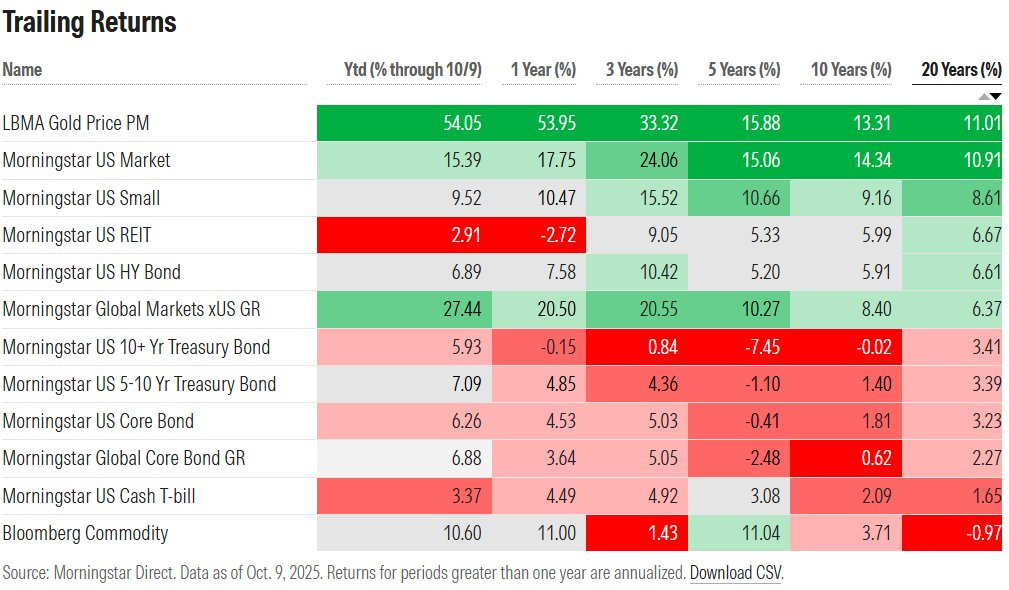

Today’s letter is brought to you by MoonPay + Exodus!Crypto should be simple, secure, and rewarding. With MoonPay and Exodus, it is.Exodus built one of the most intuitive wallets in the world, and is now a public company on the NYSE whose team is paid entirely in Bitcoin.Experience how easy crypto can be with Exodus and MoonPay. Buy, sell, or stake your favorite assets directly in-app using Apple Pay, PayPal, or your card of choice. No complex exchanges. No long waits. Just instant access to crypto in 180+ countries, powered by MoonPay.Whether you’re stacking sats or exploring new tokens, Exodus gives you the tools to manage it, and MoonPay provides the bridge to get there.Trade crypto the easy way with MoonPay + Exodus.To investors,All eyes are on gold and bitcoin as capital allocators try to figure out what is happening in the world. The narrative coming into 2025 was gold is a great asset, but it does a better job preventing losses in your portfolio than it does driving outperformance. This is where bitcoin came in.The decentralized asset was pitched as a digital gold, or as I have previously called it “gold with wings.” The idea has been that bitcoin boasts the same sound money principles as the precious metal, but bitcoin’s unique properties (including the finite supply, the bitcoin halving feature, and the relatively young life since inception) should ensure bitcoin would continue outperforming gold.That hasn’t happened in 2025 though.In fact, gold has appreciated about 60% year-to-date, which is the best performance in nearly a half century. Creative Planning’s Charlie Bilello highlights “gold is now the best performing major asset class over the last 20 years with an annualized return of over 11%.”This performance, particularly the last 11 months, has driven central bank’s allocation to gold significantly higher. Charlie writes “gold now accounts for over 20% of global central bank reserves, the highest share we’ve seen in nearly three decades.”This central bank demand is important because it overcame the fact that US retail investors have essentially been net sellers of gold and silver since the big rally in price started in March 2024.But here is the part of the story that is confusing many investors — bitcoin and gold have historically traded in tight correlation. When gold has gone up, bitcoin has followed approximately 100 days later. These two assets benefit from the same tailwinds of higher national debts, undisciplined monetary policy, and geopolitical uncertainty. In response to these issues, investors prefer to allocate larger percentages of their portfolio to sound money assets. Assets that are outside the legacy system and assets that no one can create more of.So why is gold responding to the recent global developments, but bitcoin has lagged? Is it as simple as central banks have a lot of money, so they are driving gold to outperform because these large pools of capital are not allocating to bitcoin yet?Sure, that is part of it. But there is something more nuanced at play here. Most people are too focused on gold’s outperformance and forgetting to check bitcoin’s relative underperformance. Joe Carlasare shows the current bitcoin bull market has significantly underperformed past bitcoin bull markets. We haven’t seen the breathtaking price appreciation we have come to expect, which means the market has been void of the blow-off tops driven by the retail frenzy.If you have been buying bitcoin for speculative purposes, especially if the most attractive quality was it’s perceived asymmetry, you are very disappointed right now. I wouldn’t blame you. Bitcoin has not delivered on that promise so far in this cycle.But if you were buying bitcoin as a defensive asset to protect your purchasing power from currency debasement and out of control inflation, then you likely have been good with the results. Bitcoin is up about 1,500% since January 2020 and the asset has appreciated more than 18% in 2025.The asymmetry of bitcoin came from the high degree of risk an investor was taking when they bought the asset. You get paid for the risk you take. But bitcoin is not risky anymore. It is very obvious that bitcoin is not going away, the government is not going to outlaw it, and bitcoin will eventually seep into every sophisticated investors portfolio.So you should expect bitcoin’s return to come down from past bull markets. This doesn’t make bitcoin unattractive at all. Instead, it means bitcoin’s rise is essentially pre-ordained at this point. It will take time, but bitcoin is going to win on a global stage as one of the top store of value assets. Gold will do well alongside bitcoin. These two assets are not in competition with each other, but rather they serve as brothers in the fight against currency debasement.Coexistence is a good thing for both assets.But in the short-term, we may have hit a turning point this weekend. We are most likely to see a large rotation from the gold trade into bitcoin through the end of the year. Joao Wedson writes:“Bottom signals in the BTC/Gold ratio are extremely rare, and they tend to appear during high-volatility moments and sharp BTC drawdowns. Well, we’re exactly there right now. The blue signal marks the current bottom, revealed by a normalized oscillator that’s basically screaming: “time to sell gold and buy Bitcoin.” The green signal, on the other hand, is even stronger. It shows up when both metrics align at their lows, and historically those moments have been the best BTC/Gold opportunities ever recorded. My message goes out to institutional gold accumulators: if I were you, I’d take a close look at this chart. The risk-reward profile of Bitcoin looks far more attractive right now, especially considering the current gold euphoria. Use this chart however you want. But mark this moment — it could be remembered as the turning point between Gold and BTC.”So there you have it — gold has done very well in 2025, but past performance is not indicative of future performance. We may be on the doorsteps of the great rotation from gold to bitcoin. If that theory comes true, bitcoin will likely have a fireworks ending to the year.Hope everyone has a great start to their week. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin Crashed - Here Is Why Jordi Visser Is Still BuyingJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation, we discuss the banking crisis, credit contraction, and what’s driving fear in today’s markets, Jordi shares what he’s buying, whether he’s worried about a broader slowdown, and we also touch on OpenAI’s breakthroughs, new AI models, and whether “the aliens are real.”Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Housing’s Next Act: The Fed Can Cut, But Not Save It

To investors,The housing market is widely seen as a key input for what happens in the US economy and how the Federal Reserve decides monetary policy. I asked one of my favorite X accounts to put together a guest post on the current housing situation. This person, who wishes to remain anonymous, has an X account you can follow.The beauty of anonymity is the reader is left to judge the merits of what is written, rather than assign value based on who the writer is. This guest post should help you better understand what is happening with yields and housing. I hope it is valuable to you.Here is Housing’s Next Act.The U.S. economy has shifted from late cycle wobble to clear deterioration. Job growth is fading, openings have drained toward pre-pandemic levels, and the latest ADP print turned negative. Household balance sheets are fraying where credit card and auto delinquencies are climbing toward Great Financial Crisis highs, student loan stress has re-emerged, and office vacancies are at records. In the market’s plumbing, strain is no longer subtle. SOFR has traded above the Fed’s interest on reserves, a sign dollars are scarcer at the margin while bank reserves have slipped below the $3T line once called ample. Regional bank shares are sliding again, and the Treasury curve has broken lower from the front end through the belly. None of this is random; it mirrors past moments when policy stopped transmitting and the system began hoarding liquidity. What the 2-year is signaling The 2 year yield is the market’s blunt gauge of upcoming Fed moves. Over the past quarter, it’s dropped from roughly 4% to near 3.4%, its lowest since 2022. That slide is the curve’s way of saying the Fed will keep easing not because inflation is conquered, but because credit is tightening on its own. The pattern is familiar. In 2001, the 2 year led a 500bp cutting cycle; in 2007–08, it ran ahead of the sprint from 5.25% to zero; in 2020, it collapsed before the Fed finished cutting. When the front end leads down like this, policy usually follows. Why the 10-year matters more for households The 10 year is the economy’s anchor. It sets the base rate for nearly every long term loan and reflects what markets believe about growth and inflation years ahead. Most homeowners don’t keep a mortgage for 30 years; they move or refinance every 7–10. Investors price that risk off the 10 year plus a spread for prepayment and liquidity risk. In calm markets that spread is about 1.7–2 points; when volatility rises or balance sheet space tightens, it widens toward 2.5–3. The 10 year has fallen alongside the 2 year from the mid 4s in July to just under 4%. That move signals cooling growth expectations and rising demand for safety. Yet the average 30 year mortgage remains in the mid 6s, implying a wide spread consistent with stressed liquidity. The Treasury rally is a warning. The market is bracing for a scenario where the Fed must inject reserves faster than planned. How the slowdown is showing up in housing Housing entered this phase with poor affordability, uneven regional strength, and a heavy builder footprint. As in 2006, volumes cracked before prices. Sunbelt and Mountain West metros with heavy new construction cooled first in both sales and rents. Tighter, older stock markets in the Northeast and Midwest are now following. Builder margins have compressed sharply from peak highs. Sunbelt apartment rents are falling. Active listings are climbing across the West. Builders still make up an unusually large share of supply, an aftereffect of pandemic lock in that kept resale inventory tight but now amplifies competition where new supply clusters. The biggest misconception is that Fed cuts fix affordability overnight. They don’t. When easing comes after the break, mortgage rates fall slower than fed funds because the 10 year sets the anchor and spreads stay wide until liquidity normalizes. The curve is sending that same message now. How fast the Fed can cut and how far mortgages can fall Once unemployment rises, the Fed pivots from “inflation first” to “stability first.” From 2007 to 2008, the funds rate fell 525 bps in 15 months. In 2001, 475 in a year. In 2020, 150 in two weeks. From today’s 4.25–4.50% range, a sharper downturn base case points to another 150–200 bps of easing over six months, some at meetings, some possibly between. In a severe-stress path with thinning reserves and fragile regional banks, 300–400 bps within nine months would still fit precedent. Mortgages won’t mirror those cuts. If safe haven demand pulls the 10 year to 3.0–3.25% over the next year, consistent with past recessions and spreads stay wide near 2.3 points while QT continues, the average 30 year settles between 5.2% and 5.9%. A 4 handle requires a second act with the Fed halting QT and supporting MBS liquidity, or volatility collapsing on its own. With spreads near 1.8 points and a 3% 10 year, mortgage rates could print around 4.8–4.9%. That usually takes quarters, not weeks. Prices follow volumes with a lag Demand fades before sellers adjust. Then inventory builds, listings sit longer, and prices follow. A 5–10% national decline over the next year is a reasonable base case if unemployment climbs, with deeper drops in supply elastic, investor heavy markets in the South and Mountain West. Tighter Northeast and Midwest markets may hold up better, but falling rents and slower hiring will still pressure them. The refinancing wall and policy constraints Through 2026, the U.S. must refinance roughly $9–12T in Treasury debt and $2T in commercial loans, with a heavy 2026 bulge. That narrows the Fed’s room to maneuver. Ending QT, favoring shorter term bill issuance, and expanding repo operations can ease funding stress, but those steps alone won’t bring mortgage rates sharply lower. To narrow mortgage Treasury spreads, the Fed would need calmer volatility or renewed MBS support, as in 2009 and 2020. Until then, investors will demand extra yield for prepayment and credit uncertainty as unemployment rises. Bottom line The Fed will likely cut sharply, pulling mortgage rates from the mid 5s toward the high 4s. Housing will feel it last after liquidity shifts and unemployment rises. If jobs hold, lower rates bring opportunity and better prices; if not, the downturn deepens, patience wins, and timing becomes everything.The writer of this guest post wishes to remain anonymous, but they have an X account you can follow. I believe it is one of the best X accounts to follow for macro economics.Hope you have a great end to your week. I’ll talk to everyone on Monday.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin’s $10,000 Candles Are Coming - Get ReadyAnthony & John Pompliano discuss what’s going on with bitcoin, stocks, market bubble talk, why the pessimists are wrong, what the future of predication markets look like, and why JPMorgan and Anduril are investing back into America.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Uphold - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The Vibe Shift Will Save America

Today’s Letter Is Brought To You By A Golden Visa for the Bitcoin-Forward Investor!Bitizenship helps Bitcoiners secure EU residency and a path to Portuguese citizenship, without abandoning their long-term thesis.Bitizenship Helps You:✔ Unlock visa-free travel across Europe✔ Secure residency with minimal physical presence✔ Maintain Bitcoin exposure through a regulated structure✔ Set up a future-proof Plan B for your family✔ Gain one of the world’s strongest passports in 5 yearsTime-Sensitive Update: Portugal may pass new citizenship rules within the near future, doubling the timeline to 10 years.Lucky for you, there’s time to lock in the current law if you act now.To investors,There is a vibe shift underway in America. Entrepreneurs and investors are stepping up to the plate to help solve some of our most critical problems. They are pouring trillions of dollars into various industries with one macro goal: ensure the United States continues to lead on the global stage.We saw two major announcements yesterday that further solidify the vibe shift.First, Jamie Dimon and JP Morgan committed to investing $1.5 trillion into 27 different industries they deem critical to the success of the country. These investments will happen over a 10 year timeframe and the industries include supply chain, defense, aerospace, energy, manufacturing, and frontier technologies.One goal is to increase energy independence and resilience, which can be done by investing in everything from the grid to battery storage. Another goal is to accelerate America’s position in disruptive technologies like AI, cybersecurity, and quantum.Obviously these are notable goals and critical industries, but just how will the financial institution deploy this money? They say it will be through direct equity and venture capital investments.That is exactly how it should be done in my opinion. Capitalism works because of the economic incentive for various market participants to come together and solve a problem. Jamie Dimon was quoted as saying “we’ve always worked with the government. That’s always been true my whole life, my own career. This is not philanthropy. This is 100% commercial.”It is hard to argue with that logic. There is a supply/demand imbalance in these critical industries, so the people who step up and provide solutions will be economically rewarded.The second example we got yesterday of the vibe shift came from Anduril, the leading next-generation defense company. They announced EagleEye, a new family of warfighter augmentations that place mission command & AI directly into the warfighter’s helmet.This is something right out of science fiction.Imagine a world where our ground troops have the capabilities of a computer, including computer vision, artificial intelligence, and machine learning, embedded into their helmets and the outputs available via a digital screen in their eyewear.This is going to become a reality in the near future. The only conclusion I can come to is America’s military is about to become more lethal and more effective.In a world where peace is obtained through strength, as we just saw with the peace deal in the Middle East, it is good for American citizens to have the most capable military possible.When you combine the massive investments from JP Morgan and the technology advancements of Anduril, you can easily see what is happening in our country.Risk-takers are investing time, energy, and money towards solving difficult problems. The right people have stoped complaining and they are now focused on competing globally. We have to win in AI, energy, defense, manufacturing, quantum, and every other industrial or frontier technology.It is good for investors. It is good for businesses. And it is good for our country.Game on!Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementIs Bitcoin The Only Safe Haven Now?Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation, we discuss whether there’s a bubble forming and where Jordi stands — bullish or bearish, we dive into the AI trade, the supply and demand imbalance driving energy and infrastructure, the growing “debasement trade” as institutions allocate to Bitcoin and gold, we explore capitalism vs. socialism, humanoid robots, and the macro forces shaping the markets today.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Uphold - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Trump Tanked The Market & Then He Revived It In A Single Weekend

Today’s letter is brought to you by MoonPay!Join over 30 million users who trust MoonPay as their universal crypto account.We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.Start now and get zero MoonPay fees* on your first transaction.To investors,Financial markets went into panic mode on Friday and asset prices fell aggressively. The sell-off started about mid-day, but was accelerated Friday afternoon when President Trump posted on social media saying he was going to implement a new 100% tariff on China.As if investors already have amnesia from April’s tariff scare, people raced to dump whatever assets they were holding. The stock market had just closed, so the main impact there was in after hours trading. But bitcoin and cryptocurrency markets never close. We saw those assets sell off in one of the most rapid and severe price drops that I can remember in the last decade.For example, bitcoin fell from around $121,000 to about $108,000 in mere minutes. It was one of the rare $10,000+ daily candles that bitcoiners have always dreamed of, but unfortunately it was in the wrong direction.Now before I explain why the sell-off is a positive development, you should know this market correction was not a complete surprise. I sat down with my friend Jordi Visser at 10am Eastern Time on Friday to record our weekly conversation. During that talk, Jordi explicitly called out the likelihood of a market correction in the near term. He described himself as medium-term and long-term bullish, but short-term he was much more cautious.Take a listen to why Jordi was worried:Hours later the correction began and it only accelerated throughout the day. Honestly, one of the most prescient takes someone has shared on the podcast since we began. Impressive to say the least.But the good news is that the bear market of October 2025 is officially over already. Why? President Trump took to social media on Sunday night and reassured everyone “it will all be fine” and “the USA wants to help China, not hurt it!”That reassurance is all the market needed. We saw stock futures open green last night and bitcoin surged back over $115,000 per coin.So what are my takeaways from this debacle over the last few days?First, if you sell bitcoin amid geopolitical uncertainty, you never understood what you owned. The decentralized, digital currency was built to give someone a place to save their hard-earned economic value without relying on a nation state to back it. That is not only a powerful idea, but it is an idea that should gain value as geopolitical uncertainty continues to increase in the coming years.Second, if bitcoin can fall $15,000 per coin in a day, that likely means in the future it could also go up $15,000 per coin in a day. Study reflexivity. It would take an extraordinary announcement or development for this to happen, but the market is showing us what is possible.Third, if you were bullish on bitcoin and stocks three days ago, you should be even more bullish now. None of the fundamentals changed in the last 72 hours. We simply got a healthy reset that wiped out the excess leverage in the system. Now the market is cleared to go higher.Fourth, imagine telling someone 10 years ago this headline: “The $19+ billion crypto liquidation, which is the largest in history, dropped Bitcoin’s price to $108,000.” We dreamed for days like this. We are going so much higher over time.So regardless of how you view Friday’s events, I don’t think investors are going to care or remember them in a week. This is how markets operate now. They move at lightning speed. Investors have amnesia. Everything is forward-looking. The President tanked the market on Friday. He revived it on Sunday. You may not like it, but that is what happened. And that is what is going to keep happening. Geopolitical negotiations are happening on social media. Investors will keep overreacting in the immediate term. Long-term investors don’t have to worry though. Avoid excess leverage, know what you own, and you can relax.Bitcoin’s rise is pre-ordained. They will never stop printing money, so bitcoin is never going to stop going up. God bless Satoshi Nakamoto for inventing a solution to one of the world’s most difficult problems.Hope everyone has a great start to their week. I’ll talk to you all tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementIs Bitcoin The Only Safe Haven Now?Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation, we discuss whether there’s a bubble forming and where Jordi stands — bullish or bearish, we dive into the AI trade, the supply and demand imbalance driving energy and infrastructure, the growing “debasement trade” as institutions allocate to Bitcoin and gold, we explore capitalism vs. socialism, humanoid robots, and the macro forces shaping the markets today.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Uphold - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast