Episode List

US Ratchets Up Iran Pressure; OpenAI Funding to Top $100 Billion

On today's podcast:1) While both the US and Iran have sounded cautiously upbeat about the latest round of diplomatic talks between the nations, analysts believe that strikes on Iranian targets remain a likely possibility. The US has amassed military assets in the Middle East and has dispatched a second aircraft carrier to the region. Concerns of a broader conflict held Brent crude above $70 a barrel. The US also announced new visa restrictions, with the State Department saying it is targeting 18 Iranian officials and telecommunications industry leaders and their immediate family members for the crackdown and communications blackout, blaming them for “inhibiting the right of Iranians to free expression and peaceful assembly.”2) Billionaire retail tycoon Leslie Wexner told a US House panel Wednesday that he visited Jeffrey Epstein’s private Caribbean island but said at the time he wasn’t aware of any sex trafficking operation involving the disgraced financier. Wexner said he went to the island once with his wife and children “for a few hours” while the family was in the area on their boat, according to his opening statement in a deposition to congressional investigators that was provided to Bloomberg News by his attorney. The House Oversight Committee has been investigating what role Epstein’s broad network of connections may have played in facilitating his enterprise or delaying criminal prosecution. Wexner was questioned behind closed doors by congressional investigators for six hours on Wednesday, a spokesman for the panel said.3) OpenAI is close to finalizing the first phase of a new funding round that is likely to bring in more than $100 billion, according to people familiar with the matter, a record-breaking financing deal that would give the startup additional capital to build out its artificial intelligence tools. As the ChatGPT maker prepares to spend trillions in infrastructure investment, the overall valuation of the company, including the eventual funding, could exceed $850 billion, according to some of the people. That’s higher than the $830 billion initially expected. The company’s pre-money value will remain $730 billion, said one person, all of whom asked not to be identified discussing private information.See omnystudio.com/listener for privacy information.

US & Iran Hail Progress; Ukraine and Russia Resume Talks

Today's top stories, with context, in just 15 minutes.On today's podcast:1) The US and Iran made progress in nuclear talks in Geneva on Tuesday, with Tehran’s negotiators scheduled to return with a new proposal in two weeks, a US official said on Tuesday, a cautiously upbeat assessment that suggests the chances of an imminent military clash are low. The official, who asked not to be named, said Iran would return with detailed proposals to address the remaining gaps between the two sides, but cautioned that there were still a lot of details to discuss. In an earlier statement, Iran said it had reached a “general agreement” with the US on the terms of a potential nuclear deal that would lift sanctions on Tehran and ease the risk of a broader war in the Middle East. But from the outset, there was also confusion between the US and Iranian sides on the scope of the negotiations, with President Trump bringing Tehran to the talks under the threat of US airstrikes.2) Ukraine and Russia began a second day of US-brokered talks in Geneva after Kyiv’s lead negotiator held separate meetings with American and European allies to coordinate their approach. “Consultations are taking place in groups focusing on specific areas within the political and military blocs,” Ukrainian National Security and Defense Council Secretary Rustem Umerov said Wednesday on Telegram. Russian media also reported that the negotiations had resumed behind closed doors. Umerov on Tuesday said he’d met with representatives of the US, France, the UK, Germany, Italy and Switzerland. “It’s important to maintain a common vision and coordination of actions between Ukraine, the US and Europe,” he said after the meetings in a post on Telegram. “There is an understanding of shared responsibility for the outcome.”3) Japan plans to invest up to $36 billion in US oil, gas and critical mineral projects, the first tranche of its $550 billion commitment under the trade agreement it struck with President Trump. Japanese Prime Minister Sanae Takaichi said the projects were designed to build resilient supply chains through cooperation in areas crucial for economic security, including critical minerals, energy and artificial intelligence. The most significant investment is a natural gas facility in Ohio that’s expected to generate 9.2 gigawatts of power, according to a statement from US Commerce Secretary Howard Lutnick, a massive project which Trump described as “the largest in History.”See omnystudio.com/listener for privacy information.

Jesse Jackson Dies; Iran & US Meet for Nuclear Talks

Today's top stories, with context, in just 15 minutes.On today's podcast:1) The Reverend Jesse Jackson, the civil rights leader who marched alongside Martin Luther King Jr. and later ran for president, has died at 84, according to a statement from his family released early Tuesday. Ordained in 1968, he spent decades fighting for voting rights and economic justice. A longtime advocate for racial and economic justice, Jackson was with King in Memphis in 1968 when King was assassinated. He went on to found the Rainbow PUSH Coalition and became one of the most prominent voices in American civil rights and politics.2) Iran and the US are set to meet for a second round of nuclear talks in Switzerland on Tuesday morning as they seek to avoid renewed conflict in the Middle East following last year’s attacks on the Islamic Republic. Oman will mediate the negotiations in Geneva almost two weeks after the first round was held on February 6th, Iran’s state broadcaster said. Iranian officials have expressed willingness to discuss their nuclear-enrichment activities, but have tied any concessions to the potential easing of American sanctions. Meanwhile, Washington is increasing its military presence in the Middle East, deploying a second aircraft carrier to the region amid warnings of a possible strike on Iran if talks — which could drag on for weeks — fail to produce a compromise. Iran’s Islamic Revolutionary Guard Corps held drills around the strategic Strait of Hormuz on Monday that were focused on delivering a “decisive” response to security threats.3) Secretary of State Marco Rubio said Europe’s fate is intertwined with the US while faulting the continent for what he said was a drift away from their shared Western values. “We want Europe to prosper because we’re interconnected in so many different ways, and because our alliance is so critical,” Rubio told Bloomberg News Editor-in-Chief John Micklethwait on the sidelines of the conference on Saturday. “But it has to be an alliance of allies that are capable and willing to fight for who they are and what’s important.”See omnystudio.com/listener for privacy information.

Daybreak Holiday: Walmart, Nvidia, OpenAI

On this special President's Day Holiday edition of Bloomberg Daybreak, host Nathan Hager discusses: -We get another big earnings report ahead of Nvidia. On Thursday, we hear from Walmart. For more, we hear from Bloomberg Intelligence Senior Analysts Jen Bartashas and Poonam Goyal. - Nvidia reports its latest quarterly numbers next week. So what should we expect from the chip -behemoth? We speak with Mandeep Singh and Kunjan Soubhani of Bloomberg Intelligence. -The world’s richest man, Elon Musk, is suing OpenAI, a company he co-founded. That trial is set to take place in April. We get details from Bloomberg Intelligence Litigation Analyst Matthew Schettenhelm See omnystudio.com/listener for privacy information.

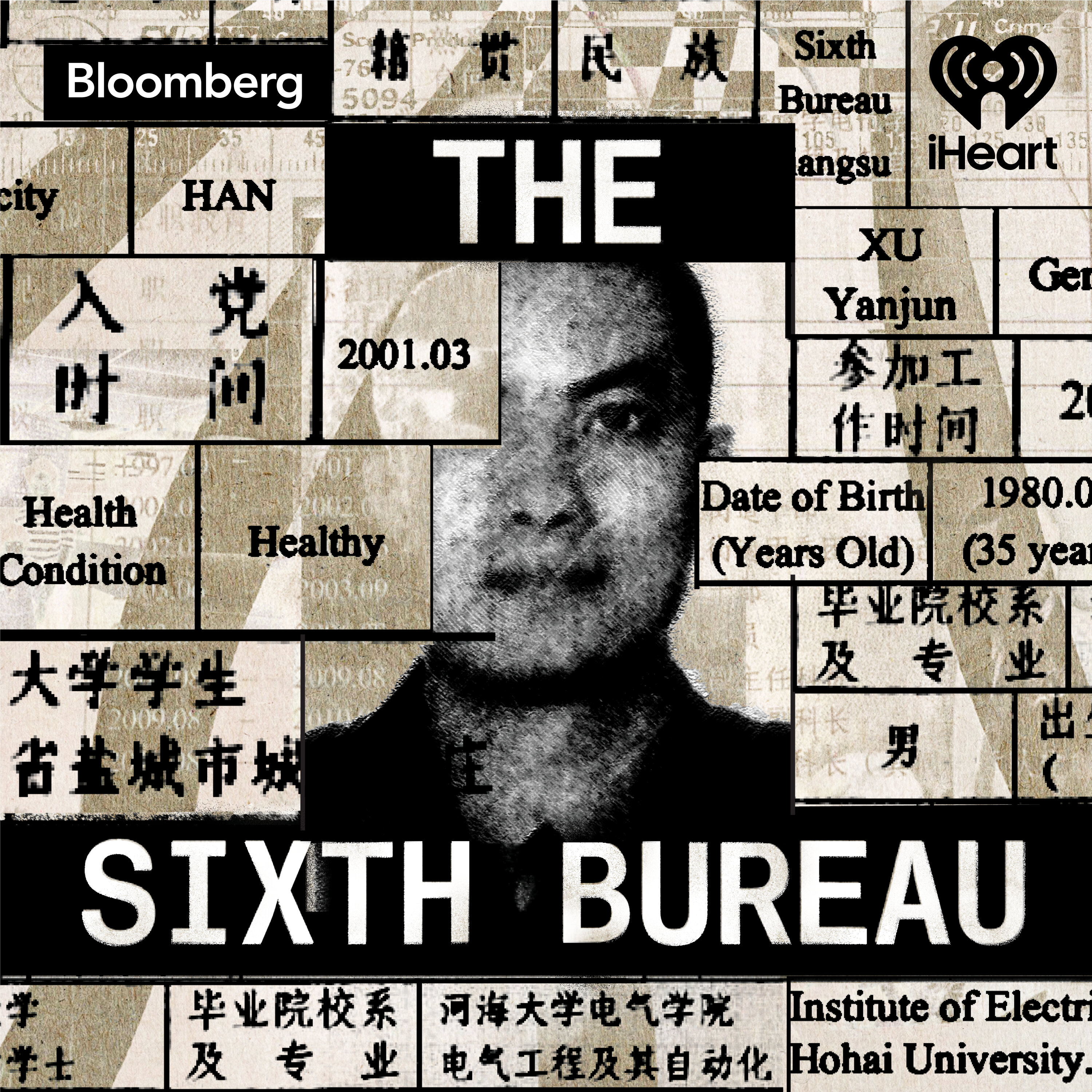

Introducing: The Sixth Bureau

It’s an open secret that the Chinese government has engaged in a global campaign to acquire intellectual property from foreign rivals. At the center of that campaign is the Ministry of State Security, China’s elusive intelligence agency. The US has apprehended hundreds of people accused of giving information to the MSS, but the agency’s inner workings have been a mystery – until now. The Sixth Bureau from Bloomberg News follows an MSS intelligence officer whose mission was to acquire the crown jewels of American aerospace companies. With aliases, blackmail and the occasional break-in, he targeted corporate giants. That is, until his sloppiness – and a cunning FBI sting – led to a stunning reversal: Xu Yanjun became the first Chinese intelligence officer ever convicted on American soil. The Sixth Bureau is the story of superpowers, their secrets and how one Chinese spy got caught. Listen to episodes 1 and 2 now on Bloomberg's Big Take podcast.See omnystudio.com/listener for privacy information.

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast