The Jobs Report Proves The Fed Is Behind The Curve

To investors,

The jobs report this morning is going to send shockwaves throughout the market. We saw growth slow to an extraordinarily low 22,000 payroll additions in the month of August.

As if that wasn’t bad enough, the June jobs revision brought the June jobs number negative. Heather Long points out the new data shows the US economy lost 13,000 jobs in June, which is the first negative month since December 2020.

She goes on to say “there's barely been any job growth in the past 4 months. Almost all the jobs added are in healthcare. Without healthcare, job growth would be NEGATIVE in the past few months.”

Not good.

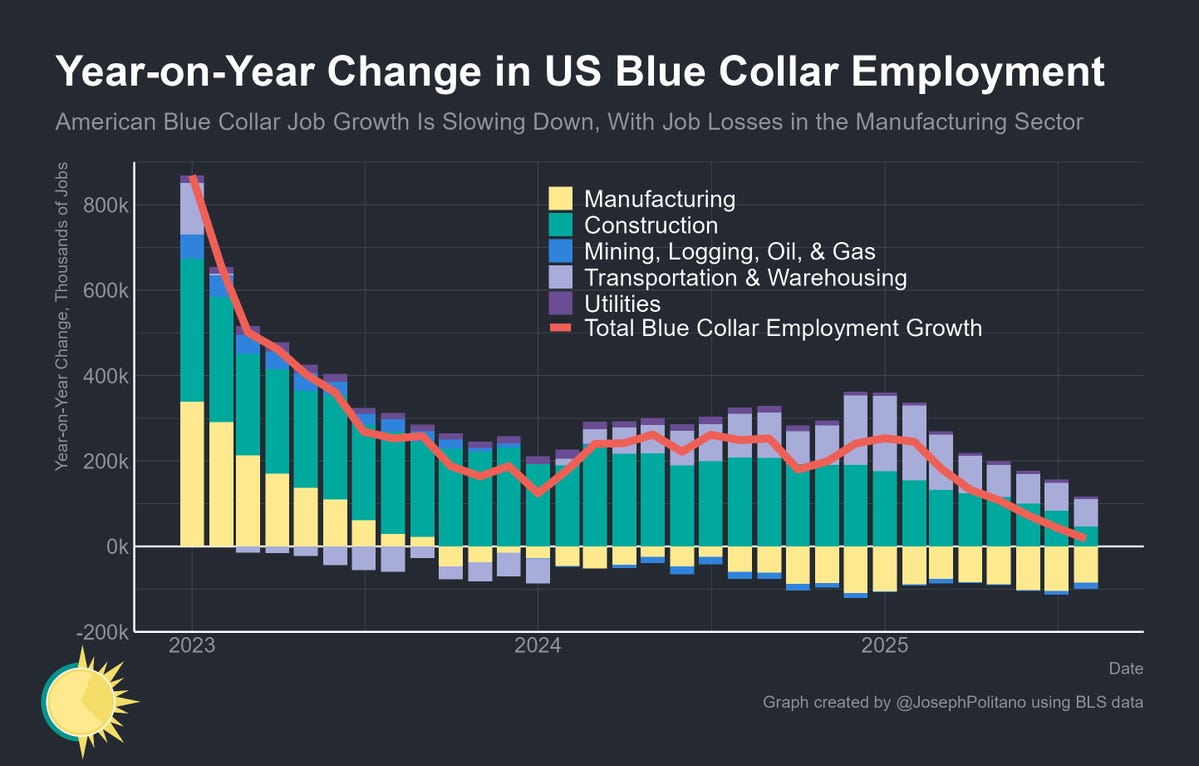

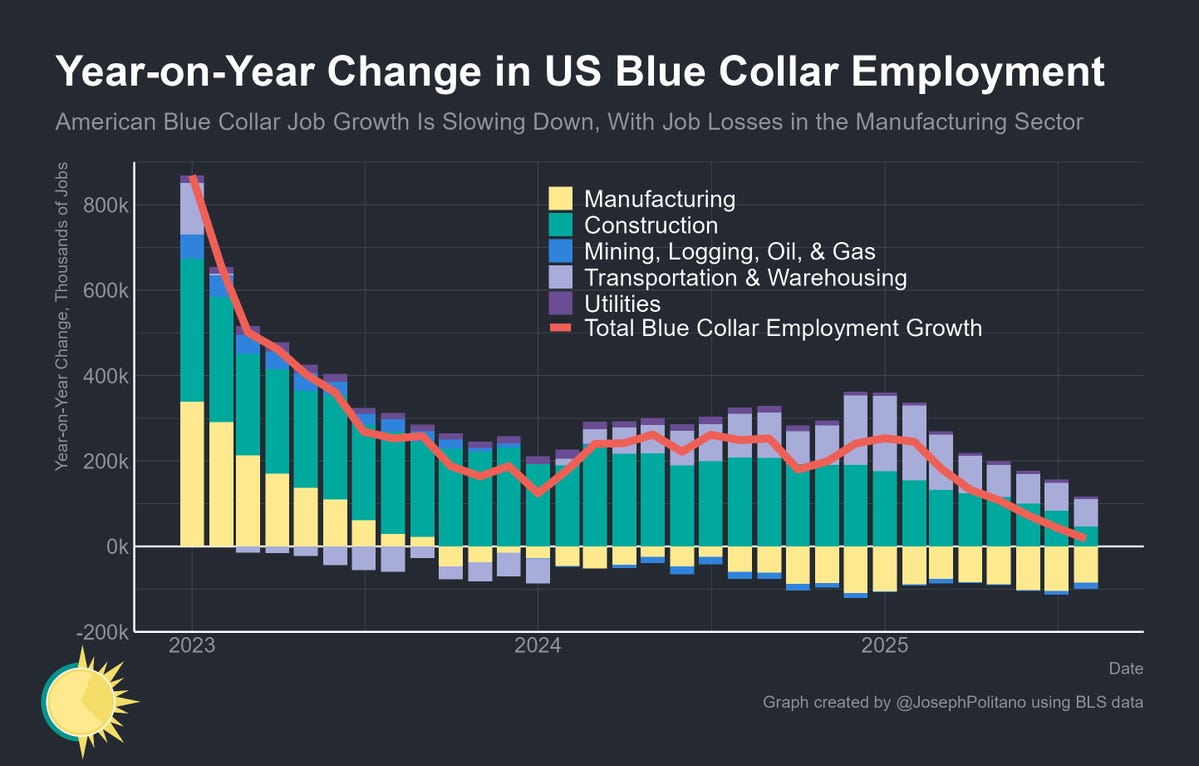

Joey Politano writes “US blue-collar job growth has completely stagnated, hitting the lowest level since the onset of the pandemic—manufacturing is currently losing jobs at a rapid pace, and growth in construction/transportation has slowed to a crawl.”

Now interestingly, white collar jobs within US manufacturing are actually growing, which is not exactly what you would expect given the public narrative right now.

But manufacturing is not the only place we are seeing the issues. Heather Long shows the job slowdown is across the economy. In the last 3 months, mining has lost 13,000 jobs, construction is down 10,000 jobs, business professionals are down a whopping 51,000 jobs, and the federal government has lost 34,000 jobs. Finance, which is largely thought to be immune to most economic policies, has also seen zero job growth over the last 90 days.

So what is going on here? Well, this brings us back to what I have been talking about all year. The US economy is getting smacked by a massive deflationary force. The combination of tariffs and artificial intelligence are a powerful cocktail that is driving significant changes in the economy.

This is why it has been so dangerous for the Federal Reserve to continue keeping interest rates at elevated levels. Their refusal to cut rates, even though the data told them to do it, has put them behind the curve once again.

Today’s job report essentially guarantees we will get a rate cut in September. It also drastically increases the odds we will see multiple rate cuts through the end of 2025.

The US economy is sprinting into a big headwind. We need the stimulus to generate the right kind of economic activity. Without it, the headwind will take its toll and make things much harder than they need to be.

As you all know, I am not a big fan of human-led monetary policy. But if we are going to use it, then the humans at the Fed should at least implement the monetary policy in a consistent, predictable way. They haven’t been doing that. Their critics claim it is for political reasons. Their supporters claim it is because tariffs were supposed to be inflationary.

Regardless of the reason, the Fed has made a big mistake and must do their best to correct the issue. I believe we should see a large interest rate cut in September. A small 25 basis point cut is unlikely to do enough to put a dent in the problem.

We should get a 50 basis point cut at a minimum and there is a serious argument for the cut to be 75-100 basis points. Now those are big numbers. The market would have a hard time swallowing such a bold move, but sometimes you have to do unpopular things in order to get the Federal Reserve back on track.

They are behind the curve. Our central bankers have completely miscalculated the impact of tariffs, and they seem to have misunderstood how pervasive artificial intelligence would be, so they should scramble to use their toolbox to get interest rates lower sooner rather than later.

This brings me to asset prices. Most assets are already trading at or near all-time high prices. If we get a large interest rate cut in September, asset prices will go much higher. The Fed can’t worry about that though. They have a labor problem on their hands. Truflation is showing inflation is under 2% right now.

That is a 50% reduction in inflation since the start of the year. The Fed should have been cutting rates. They can’t go back in time, but they can cut rates aggressively through the end of the year. And investors who are exposed to stocks, bitcoin, and gold will do well.

Now we all sit and wait to see what Jerome Powell and his crew decides to do in light of the terrible, no good jobs report from this morning.

Hope you all have a great end to your week. I’ll talk to you on Monday.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why Bitcoin Is Mispriced Right Now with Jeff Park

Jeff Park is a Partner and Chief Investing Officer of ProCap BTC.

In this conversation we talk about what separates smart investors from those who just follow ideology, how that mindset shift can make you better in the market, the idea of a bitcoin treasury company, and how businesses could stack more bitcoin without constantly raising new capital.

Enjoy!

Podcast Sponsors

* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs

* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

More Episodes

All Episodes>>Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast