The Pomp Letter (private feed for a.pinczak@gmail.com)

https://api.substack.com/feed/podcast/1383/private/cbe42756-a5cc-4c54-862b-59d95012d9fd.rssEpisode List

The Perfect Storm for Gold

Today’s Letter Is Brought To You By The Millerman School, studying Plato’s Republic!If you want to better understand the human condition and current events, and establish a solid foundation for your study of philosophy, there’s no better place to start than Plato’s Republic.And now, you can study this foundational text of Western thought in a structured, 10-week seminar led by Dr. Michael Millerman.During the seminar you’ll study Plato’s Republic from cover to cover, with:* Individual 1-1 tutoring sessions with Dr. Millerman* Live group discussions, completely off-the-record* Guidance and commentary on the text* Weekly writing challenges to help you clarify your thinking* Weekly personal feedback from Dr. Millerman, and more!There are only 30 seats available, and applications will be processed in the order received.Studying Plato’s Republic is incredibly worthwhile – and many students would say life-changing – whether you’ve read it 10 times already or are reading it for the very first time.So if you’re ready to study this foundational text, apply now.To investors,There is a gold rush underway. No, seriously.Gold has been on an absolute tear recently and many investors are wondering what has been going on.Brookings Institute’s Robin Brooks writes “The Fed’s latest dovish pivot - telegraphed on August 22 by Chair Powell at Jackson Hole - unleashed something and I don’t think anyone really understands what that is. Gold is up a stunning 15% since that day, a rally that’s so big that it stands out on this 25 year chart.”Now remember, gold is a non-productive asset. It is supposed to be a stable store of value with very little volatility on a day-to-day basis. This is why a 15% move in about a month has put all eyes on the precious metal.One of the main reasons for this move is increasing investor demand.Adam Kobeissi explains “Investors are piling into gold funds like never before. The largest gold ETF, $GLD, has attracted +$2.3 billion in net inflows so far in September. This marks the 7th monthly net inflow over the last 8 months.Year-to-date, $GLD has pulled in +$13.4 billion of capital, the most since the 2020 pandemic. As a result, gold is on track for its 7th quarterly gain over the last 8 quarters, its best streak since 2020.”These large inflows are noteworthy, but they don’t explain why so much capital is flocking to an asset that has been around for thousands of years. Robin Brooks attempts to explains this phenomenon when he writes gold “keeps rising even as the Dollar is stable against the rest of the G10. This means gold is a refuge from fiat currencies generally, not just the Dollar, as markets hunt for safe havens amid high debt and troubled fiscal outlooks. It looks like a broad debasement of fiat currencies is underway.”This broad debasement of fiat currencies should not be a surprise though. Global Markets Investor points out “currency debasement is not a bug — it’s a feature of the fiat system. Since Bretton Woods collapsed in 1971, not one of 152 countries has kept average inflation below 2%. Even Switzerland averaged 2.2%. Fiat money is in an eternal bear market.”Although it is impossible to prove, I believe the rise of bitcoin has greatly contributed to the marketing of gold. Bitcoiners have done an excellent job of calling attention to the problem with central bank activities. As Satoshi Nakamoto once said in a 2009 blog post, ‘The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”That warning could come from a bitcoiner or it could come from a gold bug. That is the beauty of sound money assets. The holders of either the analog or digital version are on the same team. They are connected in their fight against currency debasement and inflation.But we can’t exclusively point to fiat debasement or central bank buying as the cause for gold’s recent rise. We know inflation fears, increasing geopolitical tensions, and expectations of more rate cuts from the Fed are contributing factors as well.Add in the recent media coverage of the gold rally and you have the perfect storm for gold to surge higher and higher. Now the challenge for investors is deciding whether they should buy gold or abstain because they missed the rally. I don’t have an answer for you.But I am reminded of the recent analysis from Deutsche Bank’s Jim Reid:“Had you bought Gold at its peak in 1980, you will only just have outperformed inflation today, 45 years later. By contrast, if you bought the S&P 500 on that day, it would have provided you with a stunning 4,250% real return. However, had you bought gold in 2000, you would have comfortably outperformed the S&P 500 since.”Welcome to the challenge of investing. You can pick the right asset for the right reasons, yet still end up with less than desirable results. No one promised this game was easy.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementJordi Visser Explains Why Bitcoin & Artificial Intelligence Will Drive The Bull MarketJordi Visser (@JordiVisserLabs) is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation we discuss bitcoin outlook for rest of the year, interest rate cuts, how to evaluate AI acceleration, Nvidia’s $100 billion deal with OpenAI, and what metrics investors should keep an eye on.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Data Suggests The Bull Market Is Just Beginning

Today’s letter is brought to you by MoonPay!Join over 30 million users who trust MoonPay as their universal crypto account.We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.Start now and get zero MoonPay fees* on your first transaction.To investors,There is no better feeling than a bull market. Your portfolio is going higher day after day. The media is falling over themselves in excitement. Social media is lit on fire with people taking screenshots of their net worth. Bears are screeching a big crash is right around the corner. And your barber, taxi driver, and neighbor are all pitching you their latest stock pick.Straight pandemonium. Bull markets sure are fun.And that is exactly where we are right now. Stocks, bitcoin, gold, and nearly every other asset continue surging to new all-time highs throughout 2025. But just how good is this bull market? How does it compare to past markets?3Fourteen’s Warren Pies writes:“How does the [current] rally compare to history? It is the fourth strongest rally versus all other bull markets. Only 1982, 2009, and 2020 were greater. It is the STRONGEST recovery excluding recessionary cases. At 116 days without a 6% pullback, the rally has gone farther than all but two early-stage bull [markets] (1966 & 1957).”This data confirms what we are all feeling…the current bull market is very rare. The tariff fears earlier this year created an artificial suppression of stocks, which laid the groundwork for the historic market recovery we are now witnessing.There are many people arguing the recent price appreciation is unsustainable. They’ll point to numerous data points suggesting stocks are overvalued. You will hear them say a reversion to the mean is essentially guaranteed. But what if they are wrong? What if the exact opposite is true?I want to challenge each of you to ask yourself, what does the future look like if the bull market is just beginning? What if everything goes right for investors?These questions are not rooted in some fantasy world though. Carson Group’s Ryan Detrick shows “Q4 is the best quarter of the year historically and it isn’t even really close.”The last quarter of the year has an average return that is nearly twice as strong as any other quarter of the year. Ryan goes on to explain that Q4 has a positive return 14 out of the last 15 times that the S&P 500 was up 10% or more going into the final 3 months of the year.Still not convinced? Well, we can see 2025 is following a similar path to 1999. Revere Asset Management’s Connor Bates shows it perfectly in this chart comparing the 1996 - 2001 timeframe with 2023 to present day:I doubt I have 20/20 vision, but those two markets look visually similar to me. Given the trend, this comparison would suggest there is still significant appreciation left in this bull market under the 1999 repeat market scenario.And remember, all of this analysis and stock market performance is happening with the backdrop of the Fed’s recent interest rate cuts. The US central bank is reducing the cost of capital at the same time that stocks are hitting all-time highs. That development is hardly bearish and instead suggests equities will keep setting new record highs through the end of the year.That will be great for equity investors, but there is another asset that is sounding an alarm bell that can’t be ignored. That asset is gold. Mike Zaccardi shows central banks globally have been buying up gold in droves:This is just an insane amount of demand for the precious metal. Analyst Marko Papic highlights this central bank activity is about to help gold flip US treasuries as the most popular reserve asset around the world.This milestone has seemed impossible for more than 25 years. The sound money regime was dominant until 1971. We watched the explosion of fiat happen as soon as the US went off the gold standard and it seemed like sound money would be a forgotten foot note of history. But now we are seeing a return to sound money properties through gold and bitcoin.The team at Blokland shows gold’s dominance priced in US treasuries. The trend is clear and the reasoning could not be more obvious.Simply, central banks have abused the opportunity given to them by citizens. They printed too much money. They destroyed the purchasing power of the people. Citizens are choosing to vote with their dollars and move from fiat-based assets into sound money assets. These same citizens are also using stocks as a way to benefit from the insane currency debasement happening across markets.Stocks, gold, and bitcoin. Those three assets will allow you to benefit from the ridiculous, undisciplined behavior coming from central banks. Buy them and chill. They are all going higher. The bull market is not over because cheap money is coming and the world needs new technology to navigate the next two decades. I hope that each of you is able to ignore the bears. Don’t get sucked into their intellectual nonsense. They are wrong. They don’t understand the market or the economy. These individuals are stuck in the past. The optimists are going to win. Quite literally, I am betting my portfolio on it.Have a great start to your week. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementJordi Visser Explains Why Bitcoin & Artificial Intelligence Will Drive The Bull MarketJordi Visser (@JordiVisserLabs) is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss bitcoin outlook for rest of the year, interest rate cuts, how to evaluate AI acceleration, Nvidia’s $100 billion deal with OpenAI, and what metrics investors should keep an eye on.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.*Disclamer: Network, ecosystem, top-up and withdrawal fees may apply This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Should You Be Bullish or Bearish Right Now?

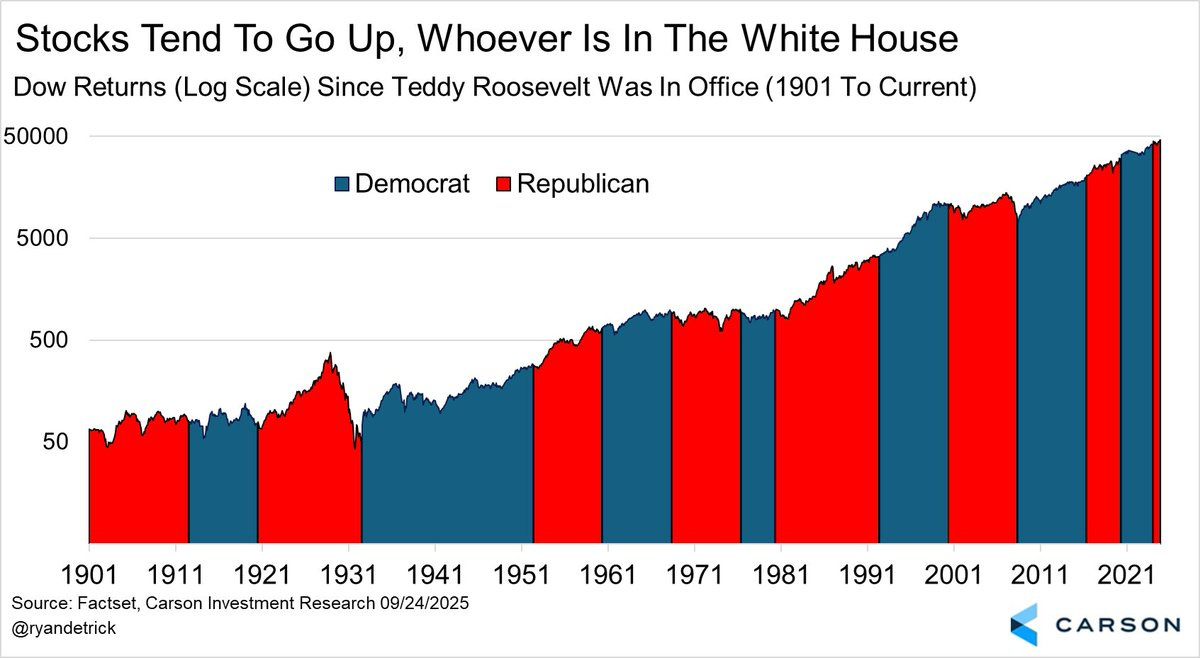

To investors,I have been spending an inordinate amount of time trying to answer the question, “what is going on in financial markets?” Some of you believe we are in a tech-enabled economic boom that will go on for years, while others believe everything is overvalued and a significant market crash is right around the corner.It is that enthusiastic disagreement that interests me. The market is ultimately the referee, so it will determine the winner, but the work I have been doing is focused on ensuring I am on the right side of the outcome.Lets start with one of the negative views of the market.Charles Schwab’s Kevin Gordon explains “The S&P 500’s forward P/E is at the same level today as it was in January 2021. Today, the effective fed funds rate is 4.09% ... in January 2021, it was 0.09%.”The X Capitalist sees this as a major red flag. He writes “The market is basically more overvalued than it was back in 2021. Investors are counting on AI to grow corporate earnings at an unprecedented rate. We haven’t seen this yet and I don’t think we’ll see it soon enough. It’s time to be more fearful than greedy.”But I don’t know if people should be as pessimistic about this data as it seems on the surface. Kevin Gordon goes on to explain the “S&P 500’s forward profit margin has been rising sharply and is at a new all-time high.”That is a great sign that profit margins are rising. This reinforces the idea that companies are growing revenue and profits, but doing it with less employees.A big reason for the investor enthusiasm we are seeing right now is artificial intelligence. JP Morgan’s Michael Cembalest writes “AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.”The AI boom is not happening in a vacuum either. Carson Group’s Ryan Detrick says when the S&P 500 makes a new all-time high in September, “Q4 is higher more than 90% of the time.”This September all-time high is being driven by a persistent bid in the market. Bloomberg reports “The S&P 500 has gone 107 sessions without a drop of 2% or more, the longest streak in more than a year.”And the backdrop of continued bullish momentum is locking arms in solidarity with the fact that odds of an October rate cut are now 94%.There are plenty of folks who will see all this economic data and say “this time is different.” They will point to some weird political policy or a critique of the existing administration, but that is all noise.Detrick shows that stocks go up under almost every President, regardless of whether they are Republican, Democrat, Independent, or an alien.Don’t let politics ruin your portfolio. Stocks are structurally built in a way where they will continue to go up forever over a long period of time. And maybe most importantly, consumers are showing the bullishness in the market is warranted.We saw the Q2 real GDP number revised higher to 3.8%, which is significantly higher than the estimated 3.3% from economists. Take a listen to how surprised CNBC was this morning:So we have much stronger than expected consumer spending, rising incomes, and lower imports. That all sounds like positive developments to me. After reviewing the economic data, I understand why some people are bearish. But I also just think they are wrong. Lets see what happens though. Time will tell and the market will be the referee. Have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementAnthony Pompliano Explains Bitcoin Outlook For Q4Anthony and John Pompliano discuss bitcoin, why gold has been doing so well, Strive buying Semler Scientific, bitcoin treasury companies, and can AI replace the Fed?Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The Fed Finally Admits Tariffs Are Not Inflationary

aWealthy people have access to the best financial insights in the world. They have large teams of people working to help them make more money. But artificial intelligence can now do it better and cheaper than those teams. We built CFO Silvia to democratize access to this important superpower and it is completely free.I’m hosting a free webinar this Thursday, September 25th at 1 PM ET to show you how I personally use Silvia, your AI CFO, to make smarter financial decisions.In this session, I’ll walk you through:* The most powerful prompts to use* How to leverage Silvia to analyze your portfolio and manage risk* New feature launches coming before the end of the year* Live Q&A with meWhether you’re a Silvia user or not, the webinar will walk you through everything you need to know: Register hereTo investors,People tend to have amnesia when it comes to financial markets. It was only a few months ago that max fear had spread like wildfire across Wall Street. People were promising recessions and depressions. They swore that tariffs would bring sky-high inflation to American consumers. And turning on your television was the fastest way to get duped into dumping every asset you owned before financial Armageddon showed up.Of course, this all looks ridiculous in hindsight. Literally insane. The US government put economic policies in place that protected US companies, encouraged GDP growth, and didn’t require an increase in prices for American consumers.Now that last part will have some of you reeling in disgust. You will still argue that tariffs are inflationary. By placing the tariffs on imports, you will claim consumers are required to pay a higher price, which would make tariffs a tax.But that has not happened. You don’t have to believe me either. Federal Reserve Chairman Jerome Powell said it himself yesterday. Here is what he said:“We’re now collecting a good bit of revenue...$300 or 400 billion dollars a year pace [from tariffs].” “Who’s paying that? So far...it looks like it’s the middle group, retailers and importers, THEY’RE NOT passing along to consumers that much of the cost. The actual impacts on inflation have been quite modest so far. It’s a small amount.”So there you have it. The leader of the United States central bank is telling you the previous consensus on tariffs was completely wrong. Tariffs have not been inflationary. In fact, Truflation shows that inflation has dropped from over 3% at the start of the year to only 2.05% as of this morning.So the Fed is telling you tariffs didn’t bring inflation. Truflation is telling you inflation went down this year, instead of up. But there are still plenty of people who will not believe it. More importantly, this entire situation was very obvious from the start. On April 3rd, one day after Liberation Day, I tweeted “Stocks and bitcoin will likely be at all-time highs again before the end of the year. All this noise will quickly be forgotten.”People were laughing at me. They thought I had lost my mind. Many people accused me of being a MAGA shill. Whatever their critique, they simply could not fathom that tariffs would not be destructive and the likelihood that stocks would go back to all-time highs by year end. Here we are though. Asset prices are at, or near, all-time high prices. Stocks, bitcoin, gold, and more. Everything has come flying back. Inflation isn’t a problem. The Federal Reserve is waiving the white flag and capitulating on interest rate cuts. And maybe most importantly, GDP is surging higher as the impact of artificial intelligence seeps into every corner of the economy.Companies are growing faster and they are doing it with less employees. Efficiency is taking over the market. Investors are increasing their portfolio values. The government is capturing hundreds of billions of dollars in newfound tariff revenue. There are still some bears out there predicting the next big market crash. But history tells us things are likely to keep improving for the foreseeable future. Cutting interest rates with stocks at all-time highs is unlikely to see stocks go down. So stop listening to the insane neighbor or your favorite economics professor on TV.Look at the data. Study history. Do the work by seeking out the source material. The pessimist always sound smart, but they rarely make money. And 2025 is just the latest example. In the words of Warren Buffett, never, ever bet against America.We are winning. And I don’t see that stopping any time soon.Hope you all have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementAnthony Pompliano Explains Bitcoin Outlook For Q4Anthony and John Pompliano discuss bitcoin, why gold has been doing so well, Strive buying Semler Scientific, bitcoin treasury companies, and can AI replace the Fed?Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Wall Street's Pessimist Has Finally Turned Bullish

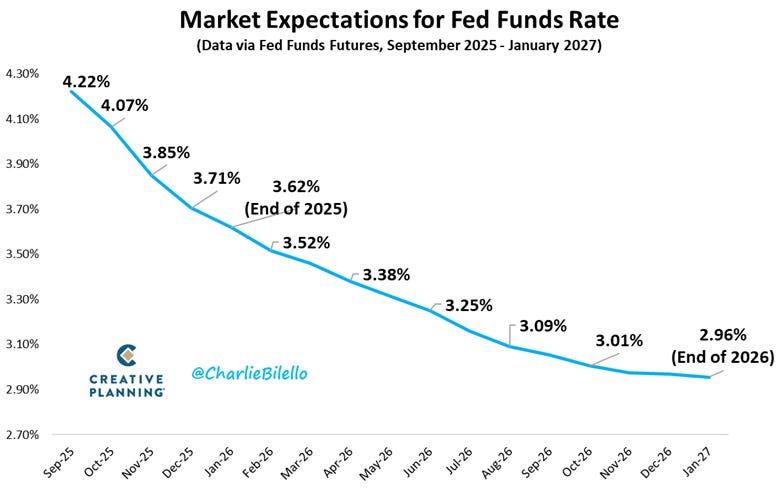

Today’s letter is brought to you by MoonPay!Join over 30 million users who trust MoonPay as their universal crypto account.We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.Start now and get zero MoonPay fees* on your first transaction.To investors,Mark Spitznagel is one of my favorite investors in the world. He is notorious for running an investment strategy that loses money for long periods of time, while hoping a big market crash is right around the corner. When the market crash materializes, Spitznagel and his firm make an insane amount of money.Spitznagel’s Universa Investments runs a tail-risk hedge fund with $20 billion in assets under management. To put this strategy in perspective, when most of Wall Street was freaking out back in April due to the tariff policies, Universa was busy booking a 100% gain that month.100% in a single month. Not bad, right?Spitznagel is one of my favorite investors because his world view balances daily pessimism with a data-driven approach to long-term patience. Not many people can intentionally lose money every day for long periods of time. Mark has written two great books on this perspective — The DAO of Capital and Safe Haven. I highly suggest reading both of them.But you may be surprised to learn Mark Spitznagel, the man betting on market crashes, is actually bullish on stocks right now.In a recent interview with the Wall Street Journal, Spitznagel said he expects stocks to surge much higher before there is any material market correction.Spencer Jakab writes:“The alarming part of Spitznagel’s current outlook is that he sees conditions akin to 1929, the year of the Wall Street crash. The silver lining for those hoping the bull-market music will keep playing a while longer: He thinks this is more like the early part of 1929 when stocks added significantly to their Roaring ’20s gains.”So the perma bear on Wall Street is actually bullish right now. Maybe that is a good sign for investors that are long, but potentially it is a sign of the market top too. I will let you decide how to interpret that development.Now Spitznagel is not alone in his recent optimism. Wisdom Tree’s Jeff Weniger writes: “The S&P 500 is up 15% this year, and the primary reason that occurred is because the big, scary Tariff War was overhyped.If you look at this like a bar tab receipt, your table ordered lobster, filet mignon, expensive wine, martinis, oysters, and more. But someone added a bowl of chicken noodle soup (the tariffs) and we were told that the soup was reason enough to panic out of stocks, send volatility to Lehman levels, send the S&P 500 reeling by the same order of magnitude as the Covid crash, and all the rest of the drama. What an interesting year.”Smart money is positioning themselves for stocks to go up too. Mike Zaccardi points out “US margin debt is now at an all-time high. Which is bullish - you want to see confirmation between stock prices and margin debt (smart money indicator).”And retail investors don’t want to be left out of this party. They had the highest weekly inflow into the market for all of 2025 last week.Of course, the Federal Reserve wants to throw gas on the fire too. Creative Planning’s Charlie Bilello shows “The bond market is pricing in 2 more 25 bps rate cuts by year-end and 3 more 25 bps cuts in 2026. That would bring the Fed Funds Rate below 3%. After a brief hiatus, easy money is back.”Easy money is back. Everyone is bullish. Even the man constantly betting on a market crash. Maybe you can be the contrarian that times the top of the market, but my guess is things in motion will stay in motion. The market is going higher. The pessimists will be left crying. And those who understand how to buy great assets and chill will be laughing all the way to the bank.Have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementMike Novogratz and Kyle Samani On The New Company They Raised $1.6 Billion ForMike Novogratz is the Founder & CEO of Galaxy. Kyle Samani is the Chairman of Forward Industries and the Co-Founder & Managing Partner at Multicoin Capital. In this conversation we talk about the $1.65 billion fundraise they recently did, how big these treasury companies can get, why they love Solana, tokenization, plans for the company, risks, and how they are going to generate shareholder returns.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast