The Pomp Letter (private feed for supernelson12@outlook.com)

https://api.substack.com/feed/podcast/1383/private/904c7ce1-d8a5-4e32-af50-820ab7f94227.rssEpisode List

The Jobs Report Proves The Fed Is Behind The Curve

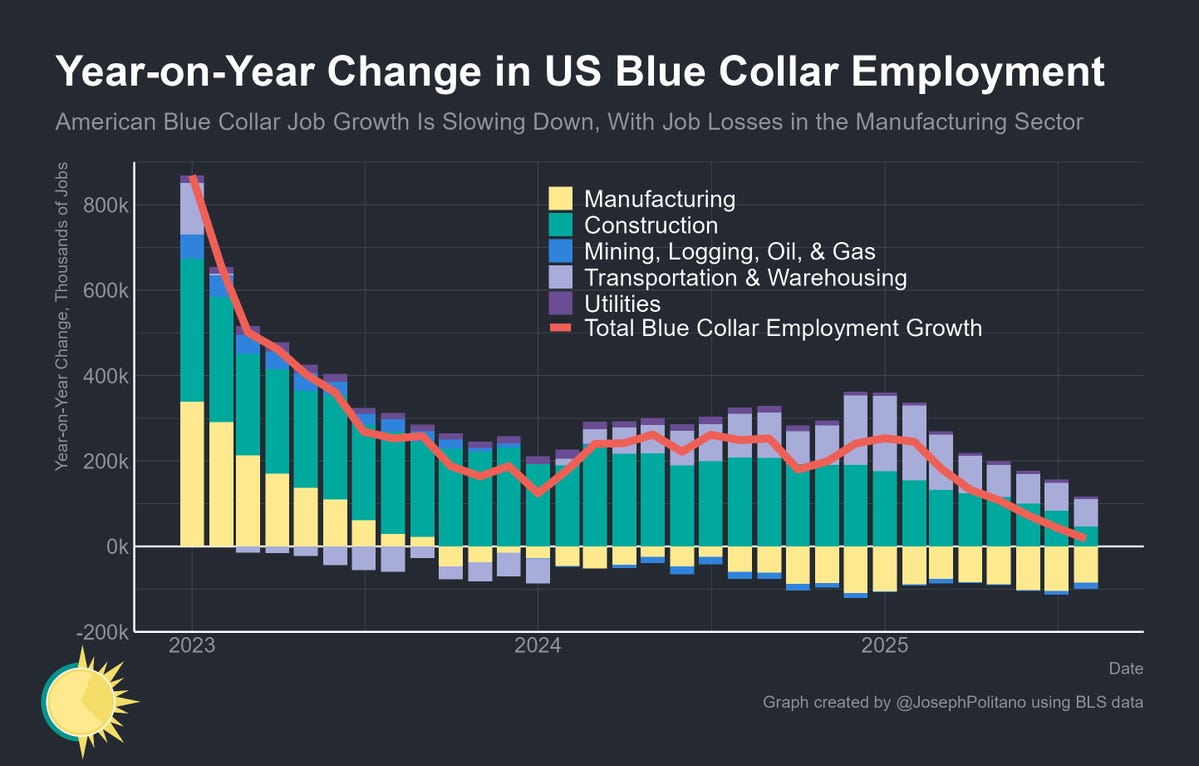

To investors,The jobs report this morning is going to send shockwaves throughout the market. We saw growth slow to an extraordinarily low 22,000 payroll additions in the month of August. As if that wasn’t bad enough, the June jobs revision brought the June jobs number negative. Heather Long points out the new data shows the US economy lost 13,000 jobs in June, which is the first negative month since December 2020. She goes on to say “there's barely been any job growth in the past 4 months. Almost all the jobs added are in healthcare. Without healthcare, job growth would be NEGATIVE in the past few months.”Not good. Joey Politano writes “US blue-collar job growth has completely stagnated, hitting the lowest level since the onset of the pandemic—manufacturing is currently losing jobs at a rapid pace, and growth in construction/transportation has slowed to a crawl.”Now interestingly, white collar jobs within US manufacturing are actually growing, which is not exactly what you would expect given the public narrative right now.But manufacturing is not the only place we are seeing the issues. Heather Long shows the job slowdown is across the economy. In the last 3 months, mining has lost 13,000 jobs, construction is down 10,000 jobs, business professionals are down a whopping 51,000 jobs, and the federal government has lost 34,000 jobs. Finance, which is largely thought to be immune to most economic policies, has also seen zero job growth over the last 90 days.So what is going on here? Well, this brings us back to what I have been talking about all year. The US economy is getting smacked by a massive deflationary force. The combination of tariffs and artificial intelligence are a powerful cocktail that is driving significant changes in the economy.This is why it has been so dangerous for the Federal Reserve to continue keeping interest rates at elevated levels. Their refusal to cut rates, even though the data told them to do it, has put them behind the curve once again.Today’s job report essentially guarantees we will get a rate cut in September. It also drastically increases the odds we will see multiple rate cuts through the end of 2025. The US economy is sprinting into a big headwind. We need the stimulus to generate the right kind of economic activity. Without it, the headwind will take its toll and make things much harder than they need to be. As you all know, I am not a big fan of human-led monetary policy. But if we are going to use it, then the humans at the Fed should at least implement the monetary policy in a consistent, predictable way. They haven’t been doing that. Their critics claim it is for political reasons. Their supporters claim it is because tariffs were supposed to be inflationary.Regardless of the reason, the Fed has made a big mistake and must do their best to correct the issue. I believe we should see a large interest rate cut in September. A small 25 basis point cut is unlikely to do enough to put a dent in the problem. We should get a 50 basis point cut at a minimum and there is a serious argument for the cut to be 75-100 basis points. Now those are big numbers. The market would have a hard time swallowing such a bold move, but sometimes you have to do unpopular things in order to get the Federal Reserve back on track. They are behind the curve. Our central bankers have completely miscalculated the impact of tariffs, and they seem to have misunderstood how pervasive artificial intelligence would be, so they should scramble to use their toolbox to get interest rates lower sooner rather than later. This brings me to asset prices. Most assets are already trading at or near all-time high prices. If we get a large interest rate cut in September, asset prices will go much higher. The Fed can’t worry about that though. They have a labor problem on their hands. Truflation is showing inflation is under 2% right now. That is a 50% reduction in inflation since the start of the year. The Fed should have been cutting rates. They can’t go back in time, but they can cut rates aggressively through the end of the year. And investors who are exposed to stocks, bitcoin, and gold will do well.Now we all sit and wait to see what Jerome Powell and his crew decides to do in light of the terrible, no good jobs report from this morning.Hope you all have a great end to your week. I’ll talk to you on Monday. - Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy Bitcoin Is Mispriced Right Now with Jeff ParkJeff Park is a Partner and Chief Investing Officer of ProCap BTC. In this conversation we talk about what separates smart investors from those who just follow ideology, how that mindset shift can make you better in the market, the idea of a bitcoin treasury company, and how businesses could stack more bitcoin without constantly raising new capital.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Bitcoin Bull Market Is Being Driven By Corporations

To investors,Bitcoin adoption happened in a special way. Most technology is first used by militaries and nation states, then corporations adopt it, and finally the average person is given access to the technology. This happened with the internet, phones, computers, and many other innovations of the last century. But bitcoin has been different.The people adopted bitcoin first. Nation states thought about banning it. Corporations thought it was too risky. It was the average person who did the work to understand the asset, realize the market opportunity, and take the leap of faith to buy and hold the world’s first decentralized digital currency.And the people have been rewarded well for taking that risk. Now corporations are working hard to catch up. Bitcoin platform River just put out a great report showing how large a percentage of bitcoin purchases now come from companies, rather than individuals.Sam Baker and Vincent Lee write “businesses have emerged as the primary force behind bitcoin's ongoing bull market. In the first eight months of 2025, bitcoin inflows onto business balance sheets have already exceeded the total for all of 2024 by $12.5 billion.”A big reason for this significant increase in accumulation from businesses has been the recent rise of publicly-traded bitcoin treasury companies. The report says these treasury companies account “for 76% of all business purchases since January 2024 and 60% of publicly reported business holdings.”Ever since Microstrategy became the first public company to hold bitcoin on it’s balance sheet, we have seen an explosion of other companies follow. It is estimated there are more than 50 other public companies who hold at least 10 bitcoin each.And these companies are not just in the United States. In fact, the bitcoin treasury phenomenon has become a global game almost overnight. There are public companies in nearly every market who continue to convert their local currency into digital sound money.So it is obvious that these treasury companies are a big reason for the continued bitcoin bull market. But it is important to remember that although these companies are buying up a lot of bitcoin, they are still slightly behind funds and ETFs which are the largest category buyer of bitcoin so far this year.It is healthy to have various types of buyers in a bull market, so it is good to see the demand is coming from funds, ETFs, treasury companies, private businesses, and individuals alike.But lets go back to the idea of companies holding bitcoin for a second. Most companies are never going to put majority of their balance sheet into bitcoin. At least not in the short-term. So a much more realistic scenario is for companies to put 1% of their balance sheet into the digital asset.1% may not sound like a lot, but look at the difference a 1% allocation would have made for Microsoft, Google, and Apple since 2020.Each of these companies has seen their balance sheet’s purchasing power erode from $14 billion to $21 billion since 2020. Think about how crazy that is. The silent tax of inflation has stolen $14+ billion of shareholder value in half a decade. Just insane.If these same companies had allocated only 1% of their treasury to bitcoin in 2020, they each would have seen a treasury gain of $14 billion to $29 billion in that same half decade. We are talking about a $25 billion swing or more in each one of these companies. And the risk they would have had to take was only a 1% allocation. Seems like a no brainer in hindsight.This brings me to my last point, which is what companies are actually doing in terms of their allocation percentage. “River's data shows that many businesses are allocating far more than a hypothetical 1% to bitcoin. Businesses using River allocate an average of 22% of their net income, according to a July 2025 survey. The median allocation is 10%.”So there you have it. An allocation as little as 1% would have had a profound impact on most company’s balance sheet since 2020, but the average allocation has been 22% of net income and the median allocation has been 10%. Something tells me those percentages will increase over time.If you want to read the full River report, you can check it out by clicking here. Hope everyone has a great day. I’ll talk to you tomorrow. - Anthony PomplianoFounder & CEO, Professional Capital Management🚨 READER NOTE: Saquon Barkley is the best running back in the NFL. He is also one of the best technology investors over the last few years.Saquon has amassed a portfolio including Anthropic (currently valued at $183 billion), Ramp ($22.5 billion), Anduril ($14 billion), Cognition ($9.8 billion), Neuralink ($9 billion), Strike (~$1 billion), and Polymarket (~$1 billion). He’s also a limited partner in funds including Founders Fund, Thrive Capital, Silver Point Capital, and Multicoin Capital.My wife, Polina Pompliano, spent months interviewing Saquon, his team, the founders in his portfolio, and those who know Saquon best. She wrote the definitive profile on the running back turned tech investor.Highly recommend reading the piece today.Why Trump & The Fed Will Make Bitcoin Keep Going UpDarius Dale is the Founder & CEO of 42Macro. In this conversation we talk about the Federal Reserve, inflation expectations, what is going on with Lisa Cook, how to fix the housing market, and how the market could play out the rest of the year.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Gold Is Appreciating Amid Heavy Central Bank Buying

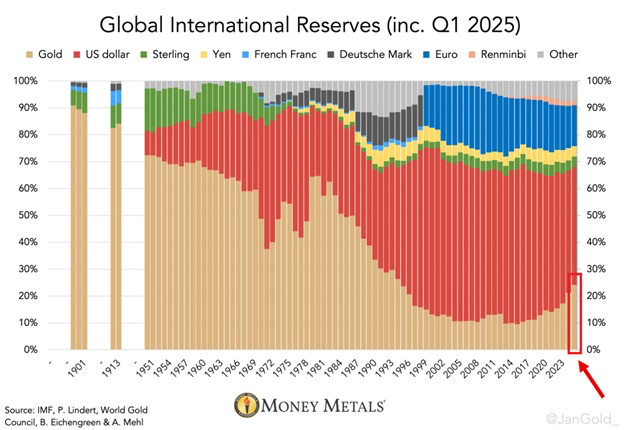

To investors,There is a seismic shift underway in how countries think about preserving their economic value for the long-term. It is imperative that you understand what is happening here because the ramifications will touch every asset class, every market, and every investor over time.Let me explain.The story is best seen through the explosion of adoption related to gold as a reserve asset for foreign governments. Adam Kobeissi writes:“Gold is replacing fiat currencies as a reserve currency: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand.”Now it is important to understand that fiat currencies will not fluctuate in price ($1 = $1), but gold’s price can appreciate. My friend Val Katayev responded to Adam saying “This is based on value. As gold price goes up, it will naturally be a higher % of global reserves since other currencies do not appreciate in value generally.”Speaking of gold’s price, it is up nearly 70% since the start of 2024. That is an epic run for an asset that historically had much more stability. Even with Val’s volatility caveat though, the significant increase in gold adoption can’t be ignored. So the market is obviously trying to tell us something. What exactly is it?I asked Silvia, the AI CFO that our team built, to explain why gold has been rallying over the last 18 months. Here is what she told me:“Gold has essentially experienced a "perfect storm" of supportive conditions: institutional demand, inflation concerns, geopolitical risks, and favorable interest rate environments all aligning simultaneously. This combination has pushed gold to historic highs and fundamentally shifted its role from primarily a dollar hedge to a critical reserve asset for uncertain times.”This explains why gold’s price is appreciating, but it doesn’t explain why central banks maintained record-high gold purchases in 2024, accounting for over 20% of global demand (compared to ~10% historically).For that answer, we can turn to Porter Stansberry. He writes:“This is the ‘End of America’ — the loss of our currency’s world reserve status — and the beginning of the end of the world’s post-Bretton Woods financial system. Anyone dependent on the government’s credit will be destroyed over the next decade.”Now as you all know, I am not usually someone who is fond of doomsday predicting. The demise of America has long been promised, yet it has not come true. But I don’t think Porter is exclusively talking about the demise of our society and our institutions. He is explicitly talking about the loss of the US dollar as the world reserve currency. That doesn’t seem too crazy, right? The bitcoiners have been yelling about this problem for years. The gold bugs have been yelling about it for decades. And now you have central banks and foreign governments who seem to have come to a similar conclusion. Maybe they aren’t ready to completely abandon the US dollar—remember the US dollar is still the most popular reserve asset for central banks globally—but they are definitely more open to reducing their allocation percentage than they had been in prior years. So this brings us to the most important question for you all. What should you do in this scenario? Is there anything you can do personally? What could you change to protect yourself and possibly benefit?Porter says “to save yourself: 1. Own a great business; 2. Hold real money — gold, Bitcoin. 3. Sell the dollar (borrow long-term, at fixed rates).” Those three ideas seem reasonable to me. And they have been helpful to people throughout history who faced similar situations. So central banks are gobbling up gold. They are loosening their dependence on US dollars. And retail investors are buying gold and bitcoin to leverage sound money properties to protect themselves. But is there something even bigger brewing under the surface? Potentially. This video of India’s Prime Minister Narendra Modi, Russian President Vladimir Putin, and Chinese President Xi Jinping went viral over the weekend. They are chopping it up like a bunch of school boys plotting how to skip class and get an extra recess session in. But this isn’t elementary school and these world leaders could significantly change the global world order if they decided to play nice with each other in a highly coordinated fashion. Investor Kashyap Sriram threw out an interesting perspective. He wrote:“5 years from now, when people ask: how did we end up in a multi-polar world order? It started with the US policy of attempting to isolate Russia from the EU, doubling down by de-globalizing free trade through tariffs, and attempting to bully India into severing ties with Russia. Honorable mention goes to nationalizing US tech giants and export controls backfiring by inducing China to develop its own advanced semiconductor tech.”Now it doesn’t take Albert Einstein to get out a hypothetical calculator and add 1 + 1 here. Central banks are looking to gold and other reserve assets at the same time that many of the largest countries have their leaders chumming it up with each other. Are we likely to see a multi-polar world emerge? Maybe. I don’t know what the end result will be. But I do know that a lot of things are changing right now and it is essential you pay attention. And it definitely won’t hurt to have sound money assets like bitcoin and gold in your portfolio.Hope you all have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementREADER NOTE: We are less than two weeks away from the Independent Investor Summit in NYC on September 12th. This is going to be an incredible event packed with actionable investment ideas from many of your favorite internet-native investors.Get your ticket by clicking here.How Bitcoin Outpaces Stocks In The Next DecadeJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we talk about the Federal Reserve, what is going to happen with artificial intelligence, future outlook for stock market, and why interest rate cuts will be so bullish for bitcoin.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Central Banks Now Own More Gold Than US Treasuries

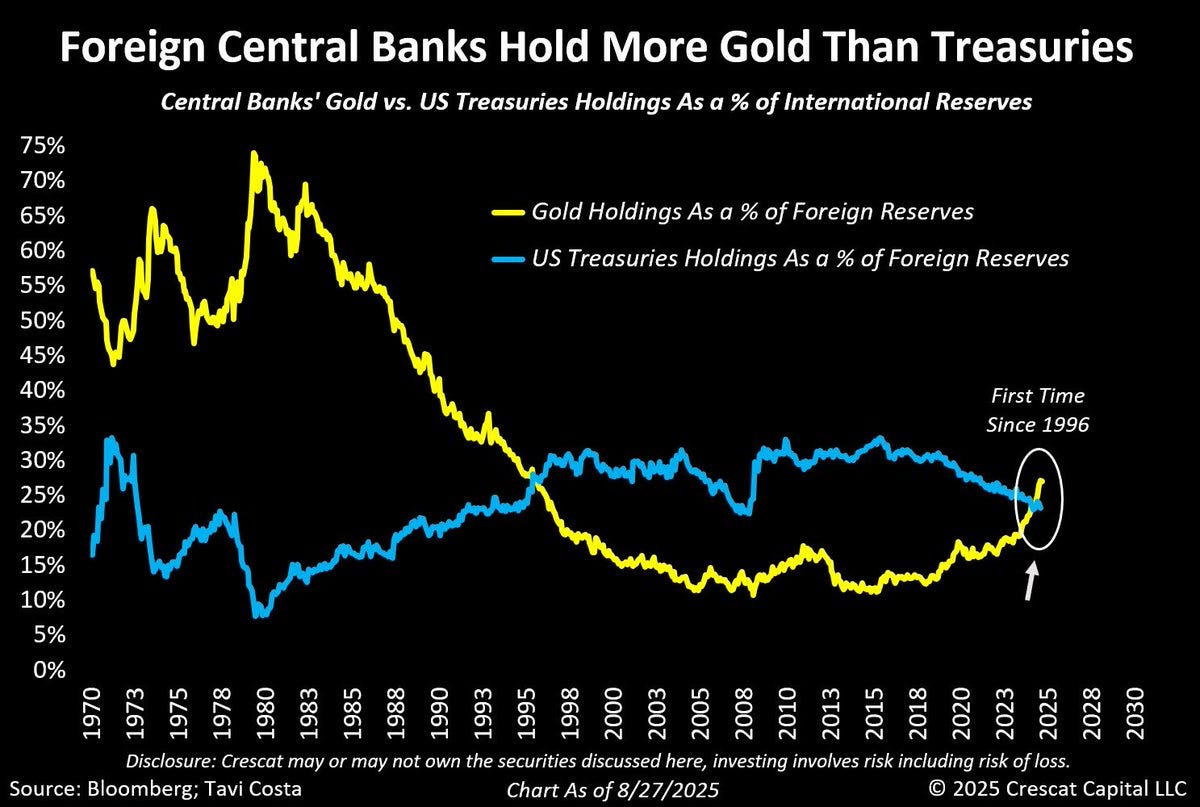

To investors,We are living through a very important shift in macro investing. You can see it clearly with a brand new development that hasn’t happened in the last 30 years. Three decades!So what is this development?Macro analyst Tavi Costa points out “Foreign central banks now officially hold more gold than US Treasuries — for the first time since 1996. Let that sink in. If you think this buying streak is ending, just look at what happened in the 1970s. This is likely the beginning of one of the most significant global rebalancings we've experienced in recent history.”Now there are a few different reasons for this outcome. First, the United States is debasing the dollar at an accelerated pace over the last half-decade. The dollar has lost nearly 30% of its purchasing power since 2000. Second, the United States has aggressively used sanctions against Russia, Venezuela, and other adversaries. This abrasive decision highlighted the risk foreign countries have when they hold US treasuries as their main reserve asset.And maybe most importantly, the rise of bitcoin, which has coincided with an epic run for gold, has solidified the belief that sound money principles never go out of style when trying to transport value through time. Central banks are waking up to the idea that holding paper probably isn’t the best strategy. Paper and treasuries can be printed at will, while hard assets are outside the control of anyone and can’t be printed. What would you rather hold? The answer is obvious.But then there is an even more interesting way to think through this problem — holding US treasuries may bring a negative real rate of return. Although the Fed continues to parrot a 2% inflation number, the real rate of debasement is 4% since 1971. This means that a treasury that is paying you less than 4% is actually losing you money on a real return basis. So now you have central banks who say “Wait! You mean I was holding an asset that could be created out of thin air, confiscated by the US government at any time, and was essentially guaranteed to lose me money?!” Makes sense why they have been dumping treasuries in exchange for gold. And eventually they will add bitcoin to their reserves as well. We live in a world where everything is fake. The money is fake. The bonds are fake. The photos on Instagram are fake. And the food is even becoming fake. This means real things — things that have objective value through finite supplies or sound money principles — will become even more valuable over time. Fake is a fad. Hard assets are timeless. And central banks realize it. So I wouldn’t want to fade the central banks. They are some of the most powerful institutions globally. They have a money printer and one day I believe they will accelerate their printing to buy more gold and bitcoin. Upgrade your portfolio. Fortify it with the hard assets. Sound money is the only money that ultimately matters.Have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy Is Bitcoin’s Price Going Down?John and Anthony Pompliano discuss bitcoin, why the price is going down, what’s going on with the Federal Reserve, Lisa Cook and the pressure from the White House, prediction for the next 10 years of the US economy, and will Powell cut interest rates?Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Data Says Artificial Intelligence Is Destroying Jobs For Young People

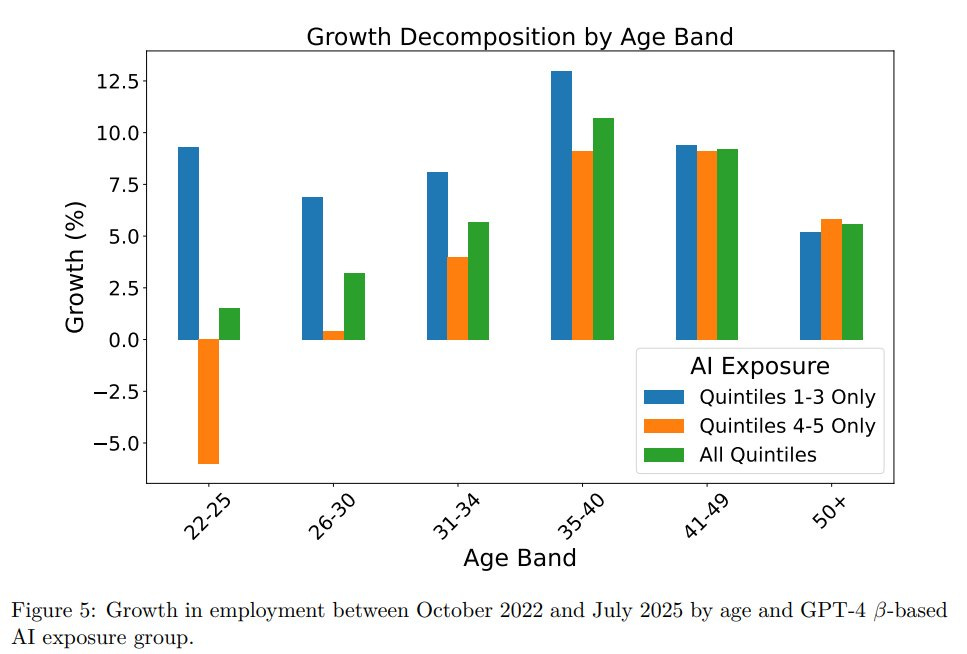

To investors,A recent study spells disaster for many young people entering the workforce right now. Simply, these young people are getting smoked in the job market due to artificial intelligence. The new paper tried to understand where artificial intelligence is driving more jobs in the economy and where AI is destroying jobs.And, as expected, the conclusions are a doozy. The paper is titled “Canaries in the Coal Mine? Six Facts about the Recent Employment Effects of Artificial Intelligence” and it analyzed data from the largest payroll software provider in the United States.According to Nic Carter, “the authors of the paper looked at job data since 2022 and divided jobs into most and least exposed to AI (quintile 1= least exposed, quintile 5 = most exposed).” He says the example "high exposure" (quintile 5) jobs include: * software developers* customer service and support* clerical roles* writing and media* business analystsSo what is happening to young people in these job categories? Do they have more or less opportunity thanks to artificial intelligence?The Economist’s Mike Bird highlights one of the main conclusion from the study: “since the widespread adoption of generative AI, early-career workers (ages 22-25) in the most AI-exposed occupations have experienced a 13 percent relative decline in employment.”This is a trend we have been talking about over the last few weeks, but now we have concrete data to quantify just how severe the situation is. A 13% relative decline in employment is a very big deal. Some may even call it catastrophic for a cohort of workers who are trying to figure out how to get their professional footing. If we dig deeper into this paper, not only did the paper find “substantial declines in employment for early-career workers in occupations most exposed to AI.” But they also “show that economy-wide employment continues to grow.”That is the killer conclusion in my opinion. Overall, the economy is growing jobs, but young people in AI-related jobs are falling significantly behind. You think that is going to be a problem in the future? Obviously. And what happens when AI continues to get better and better over time? Remember, right now is the worst the technology will ever be. So it is entry-level workers today, it will be more senior workers in a few years.But before young people go cry in a corner, there is a positive perspective on this news as well. Nic calls it a “K-shaped AI hypothesis.” I call it “Compete, don’t complain.” The idea is that AI makes it easier than ever to make a living. The barriers to starting a company, building a product, or selling a service have never been lower. Rather than praying someone is going to hire you, young people have the opportunity to accelerate their achievement of financial freedom by creating jobs for themselves. Do you need curiosity, intelligence, and creativity? Absolutely. Do you need to have agency and be a self-starter? You got it. But if a young person is hungry for success, these new tools open a world of possibility that never existed before. So the data is clear — young people are having a harder time finding work thanks to AI. But these same people can now make significantly more money, and do it much faster and easier, than their older peers. AI is a tool. You can use it for good or bad. You can use it to create jobs or destroy them. The choice is yours. Winners write history, so my suggestion is for everyone to spend a few hours to become proficient with the latest AI tools. Your career quite literally may depend on it. Hope you all have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy Is Bitcoin’s Price Going Down?John and Anthony Pompliano discuss bitcoin, why the price is going down, what’s going on with the Federal Reserve, Lisa Cook and the pressure from the White House, prediction for the next 10 years of the US economy, and will Powell cut interest rates?Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast