Is Bitcoin’s Volatility Gone Forever?

To investors,

Bitcoin’s volatility has long been a major selling point for investors to purchase and hold the asset. Retail investors saw the volatility as a way to buy bitcoin early before it went up a lot. Sophisticated, institutional investors saw the volatility as an asymmetric bet that presented the best risk-reward scenario in finance.

So what happens if the volatility starts to disappear?

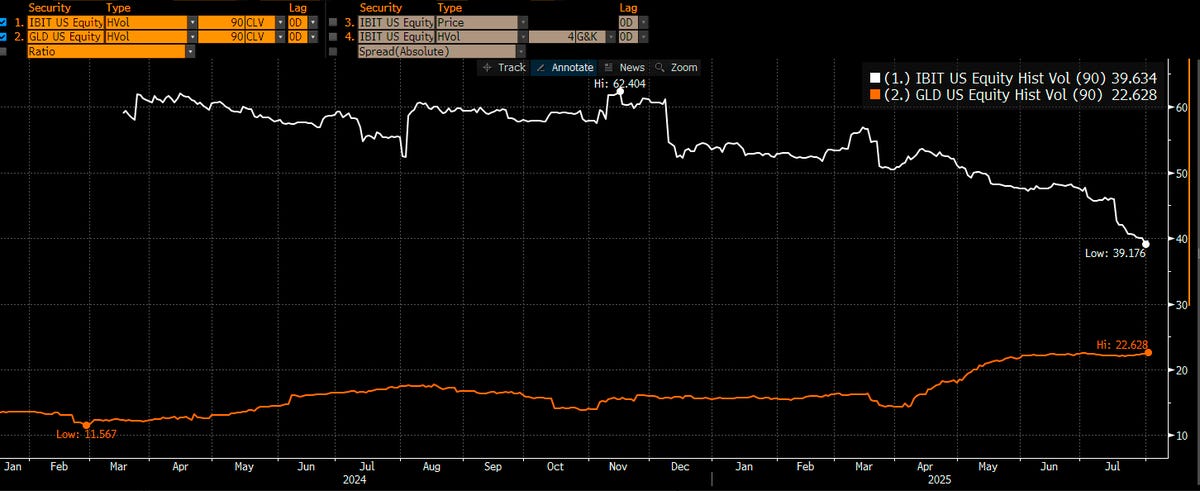

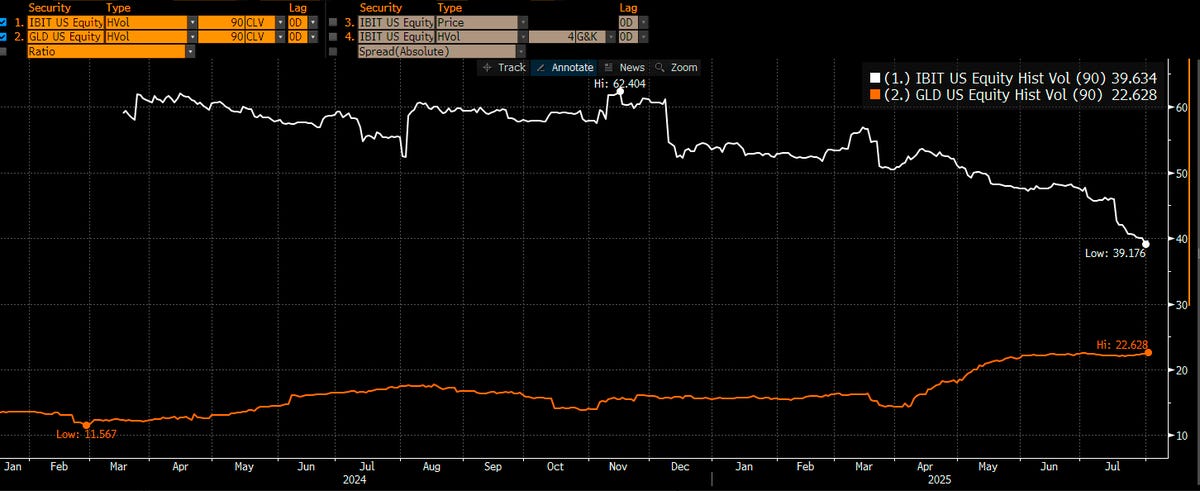

We don’t have to guess anymore, because this is starting to happen over the last two years. Bloomberg’s Eric Balchunas writes: “VOL KILLER: Since the launch of the ETFs the volatility on bitcoin has plummeted. The 90-day rolling vol is below 40 for the first time - it was over 60 when the ETFs launched. I threw in $GLD for perspective. Less than 2x gold, used to be over 3x.”

Mitchell Askew concludes this decreasing volatility means “Bitcoin looks like two entirely different assets before and after the ETF. The days of parabolic bull markets and devastating bear markets are over. BTC is going to $1,000,000 over the next 10 years through a consistent oscillation between “pump” and “consolidate" It will bore everyone to death along the way and shake the tourists out of their positions. Strap in.”

Balchunas agrees with Mitchell. Eric writes “This guy gets it. We’ve been saying same thing. Since BlackRock filing Bitcoin is up like 250% with much less volatility and no vomit-inducing drawdowns. This has helped it attract even bigger fish and gives it fighting chance to be adopted as currency. Downside is probably no more God Candles. Can’t have it all!”

But Semler Scientific’s Joe Burnett sees it a little differently. Joe says:

“Before bitcoin's 2017 parabolic bull run, volatility had been steadily declining while the price was slowly ticking higher. Over the last three years, we've seen similar behavior. Volatility has continued falling while bitcoin gradually climbs.

Now it feels like we're at another inflection point. Does volatility keep falling from here? If so, maybe bitcoin continues its slow and steady grind upward. But if we’re still early in the adoption cycle, the setup could be explosive. Governments have yet to take meaningful positions. The S&P 500 owns very little bitcoin. Institutions own very little bitcoin. And the typical portfolio still holds 0% bitcoin.

If bitcoin is already a mature asset, maybe the trend continues. But if we’re still in the early stages of global adoption, we might be on the edge of a breakout that looks more like the 2017 parabolic bull run (upward volatility).”

So what is going happen? The short answer is that no one knows. I wouldn’t bet on bitcoin staying dormant forever. The asset is known to become volatile right when everyone thinks it won’t. But I also believe bitcoin’s long-term volatility will continue to compress as the asset gets larger, more traditional finance investors hold it, and the asset transitions from a contrarian trade to a consensus trade.

Volatility is important. It brings greed and fear. It provides opportunity. And it ultimately serves as an incredible marketing campaign for bitcoin. Let’s hope the volatility is not gone. It would be incredible if the market gods blessed us with a few more years of max volatility.

Hope you all have a great end to your week. I’ll talk to everyone on Monday.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

The Summer of Bitcoin & Crypto Explained

Polina Pompliano and Anthony Pompliano discuss why bitcoin is winning, the summer of crypto, what’s changing with artificial intelligence, why the banks will have to embrace bitcoin, why Warren Buffett and Berkshire are losing, and this one idea you have to realize.

Enjoy!

Podcast Sponsors

* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

* Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

* Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

* Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

* Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

More Episodes

All Episodes>>Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast