The Pomp Letter (private feed for doczok@zoho.com)

https://api.substack.com/feed/podcast/1383/private/db96a709-b2c2-4226-af09-d32883859066.rssEpisode List

These 5 Charts Explain The Bitcoin Market Right Now

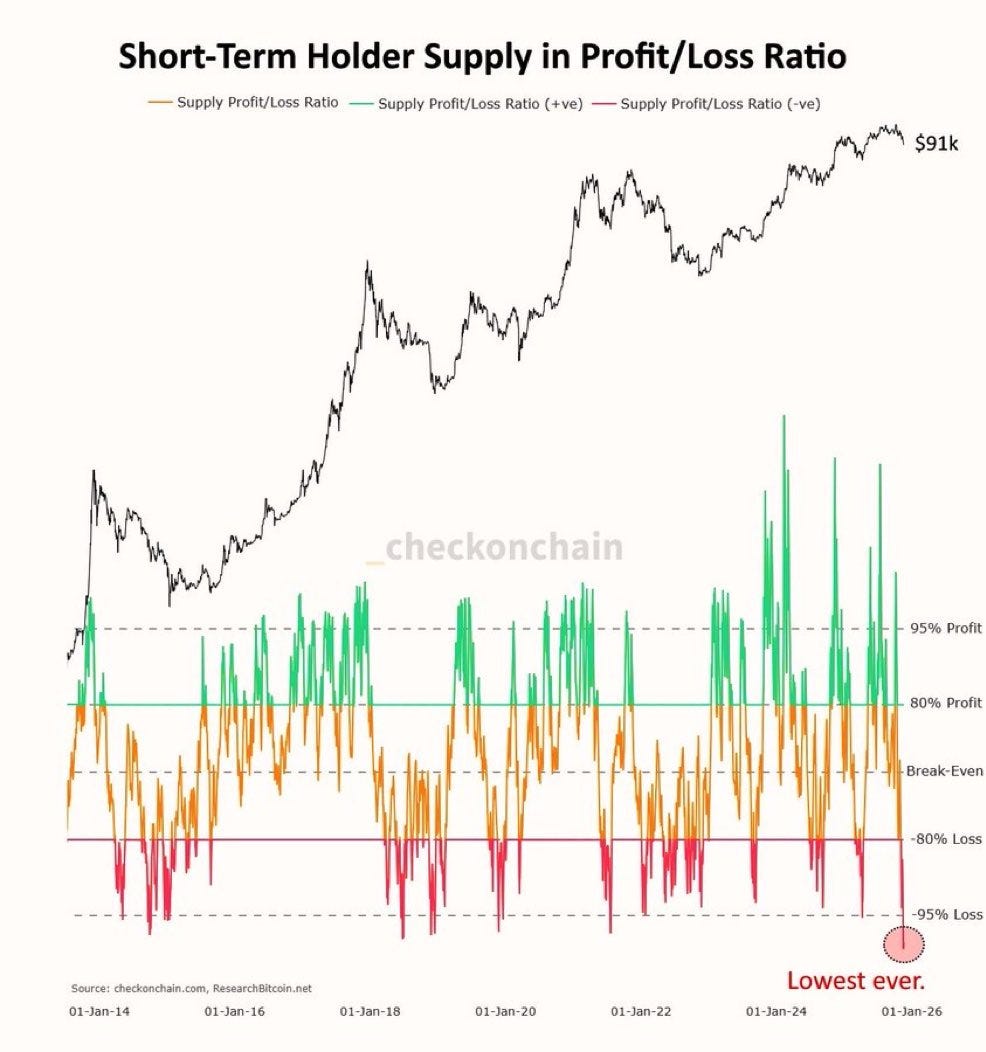

Today’s Letter is brought to you by Arch Public!Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.Talk to us today and discover why our expertise sets us apart.To investors,Bitcoin has crashed approximately 30% from the all-time high of $126,000 on October 6th. The digital currency is now negative on the year and up less than 1% over the last 12 months. As you would expect, bitcoin holders are very disappointed in the asset’s performance.Sentiment online is about as negative as I can remember it ever being. But ancedotes on the internet can be misleading. Reddit or X can be echo chambers. So what exactly is the data telling us?Here are five charts that explain what is happening.First, Zerohedge shows that “the last time bitcoin was here, global liquidity was $7 trillion lower.” That data point is a big narrative violation. Everyone, including me, expected bitcoin to close the gap between bitcoin’s price and global liquidity. Since that hasn’t happened, many people are wondering if the market has fundamentally changed now that Wall Street has started adopting the asset.Regardless of the reason, no one can dispute that bitcoin has corrected 30% in the last month and a half. James van Straten explains this is the “third 30% correction for Bitcoin this cycle. Each correction, the time from peak to trough has compressed, this has accelerated the max fear sentiment. * August 2024 (Yen Carry): 147 days * April 2025: (Tariffs) 77 days * November 2025: 42 days”And this correction has now hit oversold territory. Coin Bureau shows “Bitcoin’s daily RSI has dropped to 26, its lowest since February, putting Bitcoin in oversold territory.”Quinten Francois highlights a similar dynamic is playing out with short-term holder supply in profit or loss. We are seeing more than 95% of all coins that have been acquired in the last 155 days are now underwater.This is obviously a fast way to drive fear into a market and tank sentiment. But markets don’t bleed forever. Eventually an asset gets cheap enough where it becomes attractive to investors. Maybe that is bitcoin at $90,000 per coin or maybe it is lower. I don’t know the exact level where we see the persistent bid return. However, Bitwise’s André Dragosch says bitcoin whales, those with more than 1,000 bitcoin, have suddenly started buying bitcoin aggressively at the current price level.So we have bitcoin’s price crashing even though global liquidity is surging higher. We have an asset that is now deeply oversold, which is enticing the bitcoin whales to start buying again. And we have a Fear and Greed index that is still registering below 20.This is the volatility, chaos, and uncertainty that forged bitcoiners over the years. Those who can keep their head straight when everyone else is losing their mind have traditionally done well. It is much easier said than done though.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin Market Just ROTATED This Month - Here’s What’s NextJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation, we break down the recent sell-off in asset prices, including why the absence of a clear catalyst matters, how it may change the way you think about your portfolio, and where Jordi believes capital could rotate over the next 12–16 months.Enjoy!Podcast Sponsors* Figure - Need liquidity without selling your crypto? Figure’s Crypto-Backed Loans allow you to borrow against your BTC, ETH, or SOL with 12-month terms and lowest rates in the industry at 8.91%. Access instant cash or buy more Bitcoin without triggering a tax event. https://figuremarkets.co/pomp* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this formand someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Is The Bull Market Over?

Today’s Letter is Brought to You By Ledger x Moonpay!Security and simplicity don’t have to live in separate worlds. Experience the best of both with Ledger and MoonPay.Buy crypto instantly with the world’s most trusted hardware wallet, powered by MoonPay. Use your card, Apple Pay, PayPal, Venmo, or bank transfer directly in your Ledger Live.Together, Ledger and MoonPay make crypto simple and secure, combining cold storage protection with an effortless on-ramp trusted by millions in more than 180 countries. Your assets stay in your hands while MoonPay connects you to the entire crypto universe.Ledger is your vault. MoonPay is your key to open every digital door securely.Buy, store, and manage crypto, your way with MoonPay + Ledger.To investors,The market sell-off on Thursday and Friday last week has spooked many investors. They are wondering if the bull market in stocks is over? Are we on the cliff of a 75% drawdown in bitcoin? Will the doomsday pessimists finally have their day in the sun?These are all legitimate questions. But before we can pontificate about the future, we must analyze what is happening right now in the market. Dan Niles, founder of Niles Investment Management, had one of the best explanations over the weekend. He writes:“There were two factors driving this market this year:* Easy money due to the resumption of rate cuts.* Continued optimism on the AI trade which was also helped by the easy money to fund debt related CAPEX build outs.Recently these twin pillars of the market have been called into question:* A December 10th rate cut seems to be a toss up for the Fed with four or more dissents likely even if there is a cut.* OpenAI talking about a government backstop forced investors to question whether a company that will generate run rate revenues of $20B exiting this year can fund $1.4 trillion in infrastructure commitments.* As a result of the above, high valuations for the market in general and especially some of the more speculative sectors reliant on easy money are now being called into question.As a result, this past week while the S&P was up 0.1%, the Magnificent 7 were down 1.1% while my AI index was down 3.2% due to the concerns above. The Russell 2000 in which over one-third of the names are unprofitable and therefore more reliant on easy money was down 1.8%.”Dan’s point about investors questioning the future is hard to argue with. You can see sentiment shifting in real-time online and market prices are the signals that never lie.The White House and President Trump’s administration is not one to sit on the sidelines while the fear-mongers run wild. White House Economic Advisor Kevin Hassett went on ABC and explained why the new economic policies under the current administration is actually helping Americans:“Purchasing power dropped by about $3,000 under Biden because the wages didn’t keep up with prices. Under Trump, it’s already gone up by about $1,200. We understand that people still feel the pain of the high prices, but we’re closing the gap fast.”Treasury Secretary Scott Bessent sees an even bigger boom in purchasing power on the horizon. He was on television yesterday explaining to Maria Bartiromo how American citizens are poised to see their real purchasing power “substantially accelerate” in the first half of 2026. Take a listen:Energy prices are down. Interest rates are down. Those are both important facts when evaluating the economic policies that Bessent, Trump, Hassett and others have put into place. But my favorite part of Bessent’s conversation was his pledge to refrain from telling the American people how they are feeling. I remember when the All-In podcast guys interviewed Bessent earlier this year, they asked him if he believed the official economic data. Bessent said “no.” But more importantly, he explained that the data had been saying one thing over the last few years, but the American people were screaming from the rooftop about a different personal experience.In that situation, who are you going to believe? Do you listen to the data or do you listen to the people? Take Ritholtz’s Ben Carlson as an example. He wrote a great piece titled “What If Things Are Better Than They Seem?” In it Carlson points out the following data points:* 54% of Americans with incomes between $30k and $80k now have a taxable brokerage account and half of them have entered the stock market in the past 5 years.* Robinhood has something like 25 million customers. For half of them, it’s the first brokerage account they’ve ever opened.* Nearly 40% of 25-year-olds now have investment accounts up from just 6% in 2015.* Households with incomes below the median now account for one-third of JP Morgan customers moving money into investment accounts up from 20% in the 2010s.We’ve gone from housing being your biggest investment to the stock market. Just look at the increase in stock holdings for people under 40:Besides that being an insane chart of a 300% increase since 2020, my big takeaway is that the data may not matter. People are feeling pain. Grocery prices are too high. Electricity bills are too high. Rent and home prices are no better. It is so bad out there that the New York Times ran an op-ed recently arguing that we should implement price controls on various products and services.There is madness everywhere you look. But lets bring it back to investment assets. All this pain in the regular economy is unlikely to pull down stock prices. Companies are producing more profits with less employees. They are becoming more productive, more efficient, and more valuable. You can fake forecasts, but you can’t fake 30% year-over-year growth for a trillion dollar company.In terms of bitcoin, we just got two straight days of the Fear & Greed Index sitting at a score of 10. That is very rare. Quinten Francois shows “the average performance when Fear and Greed drops below 20:* 1 day +0.9%* 1 week +5.2%* 1 month +19.9%* 3 months +62.4%* 6 months +48.5%”So what is going to happen in the future? No one knows. But the data is telling us that the recent market volatility is less likely to be the start of a big recession or market crash across all asset classes. We may see lower prices for longer in certain sectors or assets, but the global bull market is still underway.The challenge for investors moving forward is deciding whether their investment portfolio is optimized for the long term or not. If you are sweating short term price movements, you may be holding the wrong assets or be positioned incorrectly. And, of course, leverage can be the demise of even the best investor.So I suggest everyone take a deep breath. Relax. If you are long-term oriented, everything is going to be just fine.Hope you all have a great start to your week. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin Market Just ROTATED This Month - Here’s What’s NextJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation, we break down the recent sell-off in asset prices, including why the absence of a clear catalyst matters, how it may change the way you think about your portfolio, and where Jordi believes capital could rotate over the next 12–16 months.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this formand someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Home Affordability Determines Monetary Policy, Financial Markets, and Politics

Today’s letter is brought to you by Lava!Lava’s bitcoin-backed line of credit allows you to unlock your bitcoin’s purchasing power— instantly, flexibly, and securely— without selling your bitcoin.Borrow dollars in real time with no monthly payments, open terms, and the lowest fixed interest rates in the industry— starting at just 5%.Lava is the only bitcoin lending platform available globally—you can borrow from any country or state.With Lava, you can access a full suite of bitcoin-powered financial tools:* → Borrow dollars instantly* → Earn 5% APY ****on your USD balance* → Buy bitcoin with zero feesIt’s everything you need to grow your bitcoin wealth— without ever selling your bitcoin.To investors,The home affordability crisis is having a ripple effect across American politics, financial markets, and society at large. This issue will be one of the most important things for investors to pay attention to over the next decade.First, home affordability is impacting central bank monetary policy. This summer Jerome Powell said “the best thing we can do for the housing market is to restore price stability.” Take a listen:While Powell’s comments are true that inflation stabilizing would have a positive impact on housing, the current administration believes the artificially high interest rates are also contributing to an erosion of home affordability. This makes sense…if interest rates are high, mortgage rates are high. If mortgage rates are high, fewer people can afford to own a home.This position from the Trump administration has led to a very public pressure campaign from the President, Treasury Secretary Scott Bessent, and Federal Housing Director Bill Pulte to get rates lower. Jerome Powell and the Fed will claim they don’t succumb to pressure campaigns, but the Fed started cutting rates within weeks of the public pressure ramping up over the summer. Could it be a coincidence? Sure. Do I think the lack of home affordability in America is influencing Fed monetary policy? Absolutely. But home affordability is not only affecting monetary policy. We see in financial markets that companies in the real estate market have done very well as investors place bets on various companies’ ability to solve the housing crisis. Take Opendoor as one example. Retail investors have flocked to the stock and went activist on the old management team. The CEO stepped down shortly after the activist campaign started, the company hired the former COO of Shopify, and Opendoor is now going through a significant transition from an investment company to a software company.These various changes have led to the company’s stock price going from around $0.50 at the low this year to the closing price of $9.37 per share yesterday. Can Opendoor increase access to home ownership? We are going to find out. But I became an investor in the company this year and am genuinely proud to have my investment dollars helping to fund a company that is focused on helping more Americans own a home. I suspect there are many others like me who want to see this problem solved.This is an interesting dichotomy from the performance of various home builders. Lennar is down -0.2% year-to-date, D.R. Horton is up only 6%, and NVR is down nearly 9% in the same timeframe. PulteGroup is one of the rare standouts with a nearly 13% appreciation this year.As I mentioned at the start, the housing market is having an impact everywhere. It touches on technology, tariffs, and monetary policy. It is a complex market that will create lots of mispricings over time. Investors are trying to figure out who can create value over the long run and who can’t. But nowhere is housing having a bigger impact than in American politics.We saw Zohran Mamdani get elected New York City mayor while openly running as a socialist who promised free buses, rent freezes, and government-run grocery stores. President Trump and his administration have floated the idea of a 50-year mortgage to help alleviate the financial pressures preventing young people from buying a home. And Federal Housing Director Bill Pulte told me last week in a public interview that US home builders need to build more homes or the US government may take a deeper look at what federal dollars are flowing to these companies.Monetary policy. Financial markets. Politics. Everywhere you look, home affordability is driving part of the story. So how do we fix this? What is the solution?You build more housing. Yes, it is really that simple.It doesn’t even matter what type of housing you build. You can build affordable housing and the increased supply will drive down the cost of affordable housing. More supply means lower prices. Economics 101. But recent studies show that building luxury apartments also drive down housing costs in a city. The UPJohn Institute writes:“In cities with tight housing markets, policymakers have struggled to help lower-income residents afford homes. New research shows that just building new housing—even expensive housing—can quickly drive down housing costs across metro areas, including in low-income neighborhoods.Building housing sets off a process called a migration chain, as people leave their homes to move into new units. When people vacate a given type of unit, it loosens the market for that type of unit, which lowers prices. Other people move into the newly vacant homes, leaving their previous units vacant, and the process repeats itself again and again.”So what is my big takeaway from this? The first principles solution to numerous issues and complexities in American society is to simply build more housing. It will positively impact monetary policy, financial markets, and politics. More housing pushes us back towards the American dream. More housing increases adoption of capitalism and democracy. And more housing helps American families get closer to the financial security they are passionately chasing.Hope you all have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementJordi Visser Explains Why $100K Bitcoin Is Just the Beginning Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation, we discuss Bitcoin’s “IPO moment” — why investors are feeling disappointed, what’s really happening beneath the surface, and how these dynamics could reshape portfolios in the months ahead.Jordi also shares his perspective on Tesla, artificial intelligence, and the shifting political landscape — explaining how the New York City mayor race and overall market sentiment could influence the next phase of global investing.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The Trump Put Has Arrived

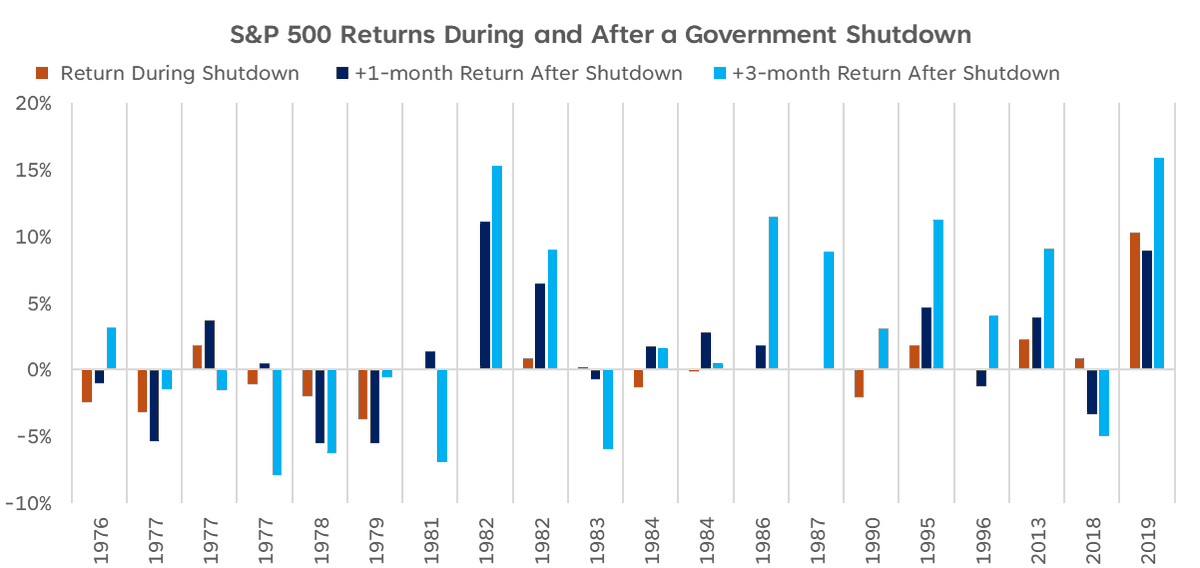

Join us at the 3rd Annual Bitcoin Investor Week!The 3rd annual Bitcoin Investor Week is returning to NYC on February 9th - 13th. This is the largest gathering of serious bitcoin investors in the world. 2,500+ people are expected this year.Speakers include Jan van Eck, Lyn Alden, Jeff Park, Anthony Scaramucci, Matt Cole, Caitlin Long, Dan Tapiero, Mark Yusko, Brandon Lutnick, Fred Thiel, and many others.TICKETS: https://bitcoininvestorweek.comTo investors,The bears have been in control of financial markets over the last few days. The S&P 500 is down 2.5% over the last 5 days. The Nasdaq is down 4% during the same timeframe. Bitcoin is down 5% over the last week. It has been a sea of flashing red numbers for a week.But have no fear, the Trump Put is here. The President of the United States of America decided to come out swinging on Sunday morning with a Truth Social post promising a $2,000 “tariff dividend” to every US citizen who isn’t a high-income earner.You didn’t think the President who measures the health of the US economy based on the stock market was going to sit around and let the bears take a victory lap, did you?Now will the tariff dividends happen? I have no idea. Polymarket odds are only at 15% right now.Another question is whether it matters if the tariff dividends actually happen? I don’t think so. The Trump Put already had its intended effect.It only took this one social media post to completely change the direction of travel for asset prices. Stocks and bitcoin have surged higher as enthusiasm returned to the market. This is the Trump Put. He has consistently made announcements that influenced the stock market at opportune times. You may remember his social media post saying “THIS IS A GREAT TIME TO BUY!!!” right before the market bottomed in April of this year. Trump backed down from his 100% tariff threat on China about an hour before futures opened on Sunday night a few weeks ago. And yesterday, amid all the panic and fear, the shining light on the hill was a simple promise from the leader of the free world to send out billions of dollars in stimulus checks.Are stimulus checks a good idea for the long term health of the US economy? Of course not. Does anyone care right now? Not really. People are too focused on the short-term fears of a stock bubble or a perceived incoming bitcoin bear market. Most people think if the President wants to hand out $2,000 to millions of citizens, especially right after a socialist agenda was voted into power in NYC due to affordability issues, then let the man hand out the money. It is complete disregard for the long-term strength of the economy and the devaluation of the US dollar.Remember, inflation can only be created in Washington DC and a fast way to increase the odds of high inflation is to hand out thousands of dollars to hundreds of millions of people. But this Trump Put is not the only thing likely to drive asset prices higher through the end of the year. We already know clarity on the China trade deal is coming. We also saw the Federal Reserve cut interest rates for the second time in the same number of meetings. And now Polymarket is showing the odds improving of the government shutdown being resolved before November 15th.Sunday morning started out with a 62% odds of the shutdown being resolved after November 16th, but throughout the last 24 hours those odds plummeted to only 7%. A big reason for this change is the report last night that an agreement was reached in the Senate that would see enough Democrats step across the aisle and vote for the government to reopen.If we get the government shutdown behind us, you should expect stocks and bitcoin to go higher quickly. Opening Bell Daily’s Phil Rosen writes “The US has seen 21 shutdowns in the last 50 years and the S&P 500 has gained 1.2% one month later and 2.9% three months later on average. Stocks are almost always higher after a government shutdown.”Altcoin Gordon shows that bitcoin rallied 50% in 3 months coming out of the last government shutdown as well.So what is going to happen here? No one knows. We are all trying to predict an unknowable future. But what I have learned in the last 5 or 6 years is to trust the vibes. Trust the sentiment. Trust the animal spirits.Whatever you want to call it. How people feel about the market tends to determine how the market performs. And last week was a great example. The fear porn and negative takes were obvious. Folks were predicting the next bitcoin bear market or the end of the stock market rally. But this week is already different. We just needed the promise of some stimulus checks to get everyone giddy again. And if everyone is giddy, capital will flow into the market lifting asset prices.I am not the smartest guy in the world, but I know not to fade the Trump Put. We got the put yesterday morning. Asset prices are responding. And the bull market is back on again.Hope you all have a great start to your week. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementJordi Visser Explains Bitcoin, Tesla, AI, and the Shifting Political LandscapeJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation, we discuss Bitcoin’s “IPO moment” — why investors are feeling disappointed, what’s really happening beneath the surface, and how these dynamics could reshape portfolios in the months ahead. Jordi also shares his perspective on Tesla, artificial intelligence, and the shifting political landscape — explaining how the New York City mayor race and overall market sentiment could influence the next phase of global investing.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

This Stock Dividend Idea Could Save America

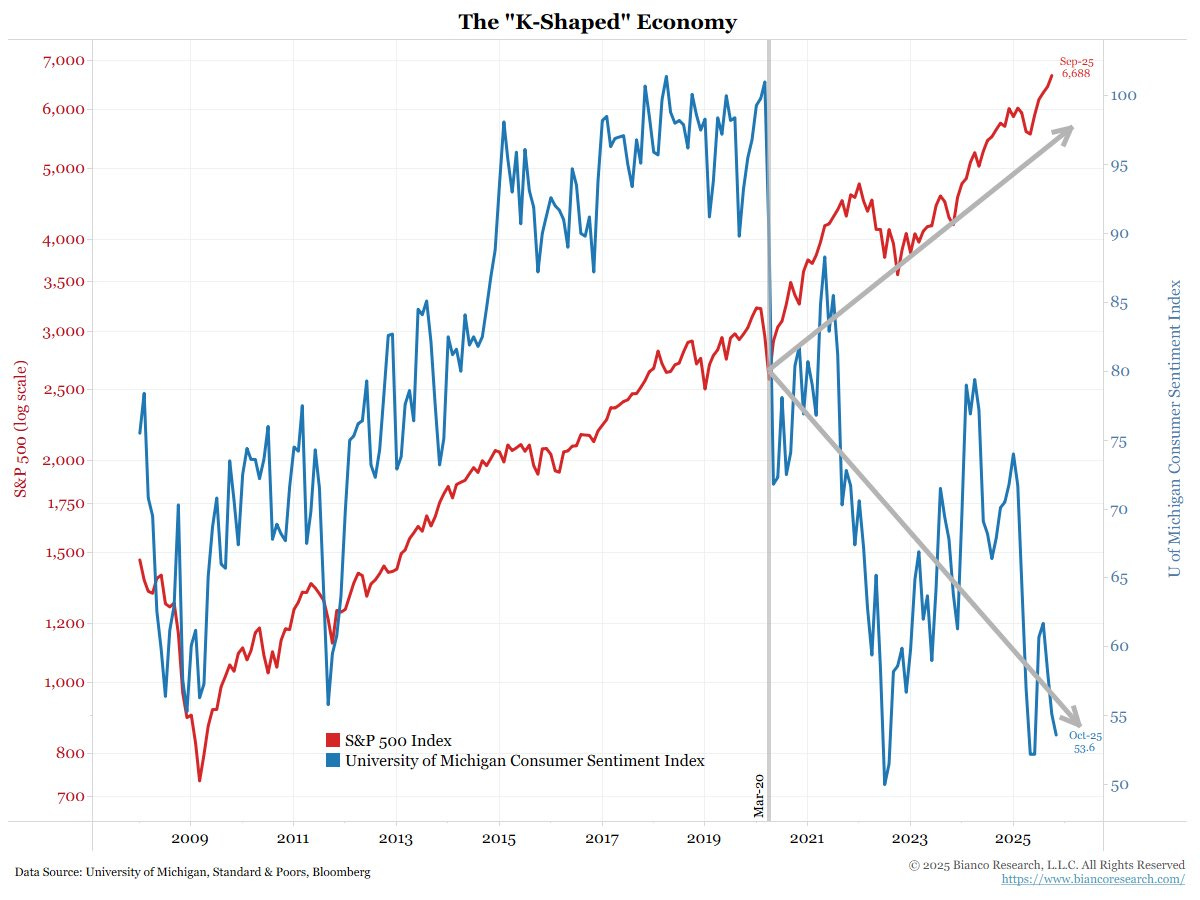

Today’s letter is brought to you by Lava!Lava’s bitcoin-backed line of credit allows you to unlock your bitcoin’s purchasing power— instantly, flexibly, and securely— without selling your bitcoin.Borrow dollars in real time with no monthly payments, open terms, and the lowest fixed interest rates in the industry— starting at just 5%.Lava is the only bitcoin lending platform available globally—you can borrow from any country or state.With Lava, you can access a full suite of bitcoin-powered financial tools:* → Borrow dollars instantly* → Earn 5% APY ****on your USD balance* → Buy bitcoin with zero feesIt’s everything you need to grow your bitcoin wealth— without ever selling your bitcoin.To investors,The US economy is in a very weird position. We are watching companies accelerate their earnings, while the job market is declining at a rapid pace. You will read headlines about how great everything is going followed by headlines about how horrible everything is.Both perspectives are true. It just depends where you are looking.Take corporate earnings as a positive example. Creative Planning’s Charlie Bilello writes “with 70% of companies reported, S&P 500 operating earnings are up 19% year-over-year, the 11th straight positive quarter and highest growth rate since Q4 2021.”Given how well corporations are doing, you would expect investors to be euphoric. Their portfolios are growing in value and stocks keep climbing higher. But in the surprise of the year, investors are incredibly negative right now.Carson Group’s Ryan Detrick points out investor sentiment currently sits at Extreme Fear even though “a few days ago the S&P 500, Russell 2000, Dow, Nasdaq, and Nasdaq-100 all closed at new monthly all-time highs.”It is crazy to think about stocks at all-time highs, yet investor sentiment in the toilet. Those are the type of ingredients that almost certainly guarantee we can’t be at a market top. The sentiment divergence is not exclusive to investors either. Jim Bianco shows consumer sentiment is falling rapidly as well. He writes “Red is the stock market. It’s going straight up. Rate cuts help. Blue is consumer sentiment, it’s going straight down and is near a multi decade low. Inflation (affordability) is driving this measure lower. Rate cuts hurt.”Lets go back to investors for a second though. Ryan Detrick goes on to explain that the market is overwhelmed with bearish investors. They are everywhere. He writes “AAII bulls minus bears is -11.1% in 2025. Only 3 other times has this ever been -10% and all happened in bear markets (1990, 2008, and 2022). Incredibly, bears outnumber bulls by 11.1% in ‘08, the exact same level as in 2025 so far.”But the dichotomy gets even weirder when you dig deeper into the data. Commerce Secretary Howard Lutnick was asked about the US economy last night in an interview and he said “Which way is the stock market going? Up, up, up! Which way is the economy going? 3.8% last quarter... the economy is on fire because Donald Trump’s economy is one that says... BUILD IN AMERICA.”Lutnick is not wrong. But contrast that with the jobs data that came out this morning. CNBC’s Jeff Cox explains:“Job cuts for the month totaled 153,074, a 183% surge from September and 175% higher than the same month a year ago. It was the highest level for any October since 2003. This has been the worst year for announced layoffs since 2009.”So the economy is booming but the job market is deteriorating. Stocks are flying higher, yet sentiment is succumbing to gravity. The obvious culprits are artificial intelligence and interest rate cuts. Both trends help corporations and asset owners at the expense of the average citizen who has little to no investment assets.I don’t know what the solution to this problem is. The complexity here is hard to overstate. You can’t allow corporations and asset owners to be destroyed because job losses will only accelerate. You can’t continue to have half of the country being financially destroyed due to technology, economic conditions, and a lack of financial education.This may be one of the great challenges of our time. We have to walk a tight rope between these opposing forces. A potential solution is to get more Americans invested in the capitalist system. Programs like Invest America, which wants to fund a stock brokerage account for every baby born in America, could have a positive impact. The issue with a program like that is it will take decades to see the impact.It doesn’t mean we shouldn’t pursue the program. We just can’t count on it as a magic solution today. One idea I have been thinking through is a “Stock Dividend” to the American people. It could work as a potential tax rebate. The government would determine an amount to be returned to every citizen, but rather than pay in cash, the government would deliver shares of the S&P 500 or Nasdaq.There are a lot of nuances that would have to be figured out. And we have to remember a large portion of the country doesn’t pay federal income tax, so you would have to account for those people in the program too. But this type of creative, entrepreneurial idea would get every American a stake in the economic system. It would have a profoundly positive impact on their financial life and it would likely create a less divisive political environment.The people are screaming they need help. How the government, the economy, and corporations decide to respond will determine a lot about the next few years in the United States.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin’s Big Risk ExposedJeff Park is the Partner and Chief Investment Officer at ProCap BTC. In this conversation, we dive into the current bitcoin market cycle — why price sentiment has shifted, whether younger investors are losing interest, and where the next wave of buyers could come from.Jeff also breaks down how both macro forces like interest rates and micro market dynamics are influencing bitcoin’s trajectory, and reacts to Scott Bessent’s viral tweet that might signal a turning point for crypto markets.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast