The Pomp Letter (private feed for doczok@zoho.com)

https://api.substack.com/feed/podcast/1383/private/db96a709-b2c2-4226-af09-d32883859066.rssEpisode List

This Stock Dividend Idea Could Save America

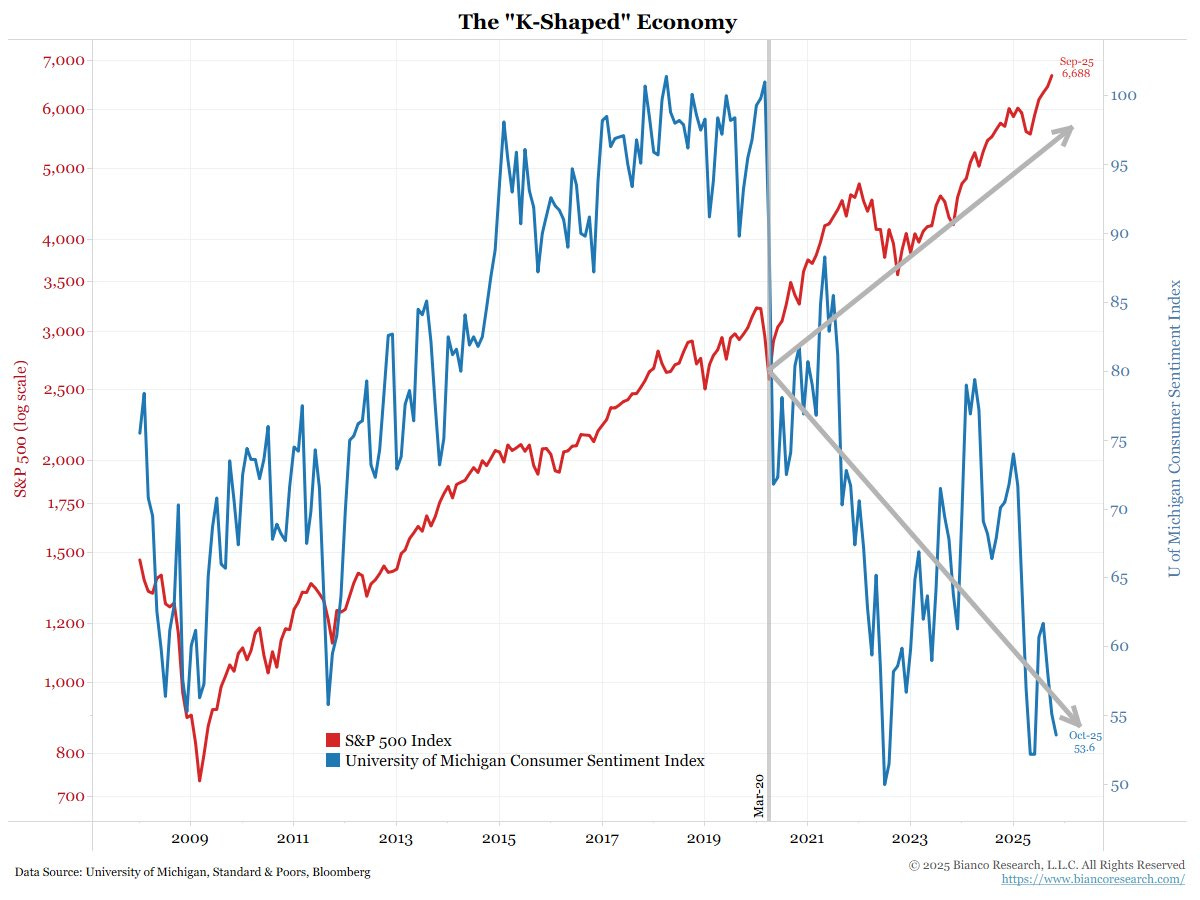

Today’s letter is brought to you by Lava!Lava’s bitcoin-backed line of credit allows you to unlock your bitcoin’s purchasing power— instantly, flexibly, and securely— without selling your bitcoin.Borrow dollars in real time with no monthly payments, open terms, and the lowest fixed interest rates in the industry— starting at just 5%.Lava is the only bitcoin lending platform available globally—you can borrow from any country or state.With Lava, you can access a full suite of bitcoin-powered financial tools:* → Borrow dollars instantly* → Earn 5% APY ****on your USD balance* → Buy bitcoin with zero feesIt’s everything you need to grow your bitcoin wealth— without ever selling your bitcoin.To investors,The US economy is in a very weird position. We are watching companies accelerate their earnings, while the job market is declining at a rapid pace. You will read headlines about how great everything is going followed by headlines about how horrible everything is.Both perspectives are true. It just depends where you are looking.Take corporate earnings as a positive example. Creative Planning’s Charlie Bilello writes “with 70% of companies reported, S&P 500 operating earnings are up 19% year-over-year, the 11th straight positive quarter and highest growth rate since Q4 2021.”Given how well corporations are doing, you would expect investors to be euphoric. Their portfolios are growing in value and stocks keep climbing higher. But in the surprise of the year, investors are incredibly negative right now.Carson Group’s Ryan Detrick points out investor sentiment currently sits at Extreme Fear even though “a few days ago the S&P 500, Russell 2000, Dow, Nasdaq, and Nasdaq-100 all closed at new monthly all-time highs.”It is crazy to think about stocks at all-time highs, yet investor sentiment in the toilet. Those are the type of ingredients that almost certainly guarantee we can’t be at a market top. The sentiment divergence is not exclusive to investors either. Jim Bianco shows consumer sentiment is falling rapidly as well. He writes “Red is the stock market. It’s going straight up. Rate cuts help. Blue is consumer sentiment, it’s going straight down and is near a multi decade low. Inflation (affordability) is driving this measure lower. Rate cuts hurt.”Lets go back to investors for a second though. Ryan Detrick goes on to explain that the market is overwhelmed with bearish investors. They are everywhere. He writes “AAII bulls minus bears is -11.1% in 2025. Only 3 other times has this ever been -10% and all happened in bear markets (1990, 2008, and 2022). Incredibly, bears outnumber bulls by 11.1% in ‘08, the exact same level as in 2025 so far.”But the dichotomy gets even weirder when you dig deeper into the data. Commerce Secretary Howard Lutnick was asked about the US economy last night in an interview and he said “Which way is the stock market going? Up, up, up! Which way is the economy going? 3.8% last quarter... the economy is on fire because Donald Trump’s economy is one that says... BUILD IN AMERICA.”Lutnick is not wrong. But contrast that with the jobs data that came out this morning. CNBC’s Jeff Cox explains:“Job cuts for the month totaled 153,074, a 183% surge from September and 175% higher than the same month a year ago. It was the highest level for any October since 2003. This has been the worst year for announced layoffs since 2009.”So the economy is booming but the job market is deteriorating. Stocks are flying higher, yet sentiment is succumbing to gravity. The obvious culprits are artificial intelligence and interest rate cuts. Both trends help corporations and asset owners at the expense of the average citizen who has little to no investment assets.I don’t know what the solution to this problem is. The complexity here is hard to overstate. You can’t allow corporations and asset owners to be destroyed because job losses will only accelerate. You can’t continue to have half of the country being financially destroyed due to technology, economic conditions, and a lack of financial education.This may be one of the great challenges of our time. We have to walk a tight rope between these opposing forces. A potential solution is to get more Americans invested in the capitalist system. Programs like Invest America, which wants to fund a stock brokerage account for every baby born in America, could have a positive impact. The issue with a program like that is it will take decades to see the impact.It doesn’t mean we shouldn’t pursue the program. We just can’t count on it as a magic solution today. One idea I have been thinking through is a “Stock Dividend” to the American people. It could work as a potential tax rebate. The government would determine an amount to be returned to every citizen, but rather than pay in cash, the government would deliver shares of the S&P 500 or Nasdaq.There are a lot of nuances that would have to be figured out. And we have to remember a large portion of the country doesn’t pay federal income tax, so you would have to account for those people in the program too. But this type of creative, entrepreneurial idea would get every American a stake in the economic system. It would have a profoundly positive impact on their financial life and it would likely create a less divisive political environment.The people are screaming they need help. How the government, the economy, and corporations decide to respond will determine a lot about the next few years in the United States.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementBitcoin’s Big Risk ExposedJeff Park is the Partner and Chief Investment Officer at ProCap BTC. In this conversation, we dive into the current bitcoin market cycle — why price sentiment has shifted, whether younger investors are losing interest, and where the next wave of buyers could come from.Jeff also breaks down how both macro forces like interest rates and micro market dynamics are influencing bitcoin’s trajectory, and reacts to Scott Bessent’s viral tweet that might signal a turning point for crypto markets.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The People's Voice Was Heard Last Night

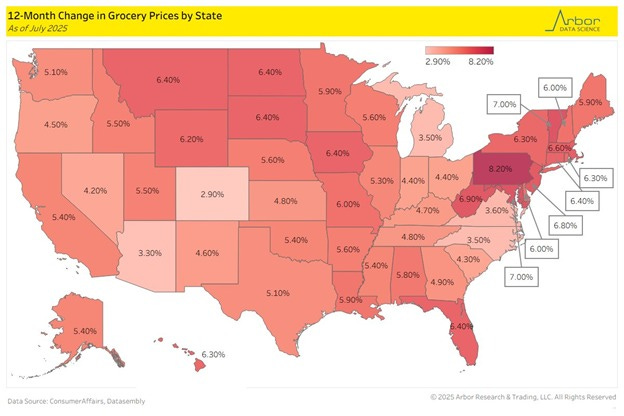

Today’s Letter is brought to you by Arch Public!Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years. The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions. Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence. Talk to us today and discover why our expertise sets us apart.To Investors,We saw Democrat candidates win major races yesterday for Governor of Virginia, Governor of New Jersey, and mayor of New York City. This is a good ‘ole fashion ass kicking. A straight rout across the board in favor of the Democrats.Half of the country is waking up happy this morning and the other half is left wondering how we got to this point. But put politics aside for a second.There is a very important finance and economics story smacking us in the face. The voice of the people was heard last night. They are clearly telling the world that rent is too high, groceries are too expensive, the system is not working for them, and change is needed.You can see these problems clearly in the data.First, the difference in sentiment between the people who make more than $100,000 and those who make less than $100,000 is widening. You can see this clearly getting worse since the summer of 2022 and accelerating in 2025.You can call it a k-shaped economy. You can call it a bifurcation. No matter what you call it, the economy is being split into two groups: those that own assets and those that don’t.This k-shaped economy related to sentiment passes through to consumer spending habits. We know that the top 10% of earners account for half of US personal spending.But when you dig into consumer prices of every day items like groceries, you can see a very big problem. Adam Kobeissi writes “US grocery prices have risen +5.3% YoY as of July 2025. To put this differently, if a family spends ~$1,000 a month or $12,000 a year on groceries, this marks an average annual increase of +$636.”Home affordability doesn’t offer a much different story. Kobeissi continues by showing “it would take a -38% drop in home prices OR a +60% JUMP in household income JUST for affordability to go back to 2019 levels. You must now make ~$113,000/year to afford the MEDIAN home in the US.”The problem is only going to get worse in the short-term too. For example, artificial intelligence is driving a wedge into the job market. You see the people who are using AI continue to grow revenue and profits, while the working class is watching job openings fall off a cliff as AI begins replacing many jobs.So the financial answer is for people to acquire assets. Bill D’Alessandro shows this chart of wage growth vs. asset appreciation. He says “you’ve got to be converting your time/wages into assets. Best time to start was 20 years ago, second best time is now.”So when I think about what is happening here, you have to believe multiple things are true. The people are voicing their opinion for a reason. Affordability in America is way too high. We have to bring that down and provide relief for millions of people. You also have to see that the financial answer is for more people to own assets, but understand why that is nearly impossible to get people to do. Our schools don’t even teach financial education, let alone most young people having the ability to understand investing.At the same time, the rise in popularity for dumb ideas like socialism is a response to the affordability crisis. If you don’t have a financial solution, you immediately look for a different release value. It is easy to get swindled by a charismatic guy who promises a bunch of free things, especially when that guy is explicitly acknowledging the pain that you are experiencing. It doesn’t make the socialist ideas good. But it is understandable why the message resonates. Over the coming weeks I will explore the various ways this change is going to impact financial markets, but I will leave you with one of the important truths I have come to believe: the voice of the people will ultimately be heard.And their message was crystal clear last night.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementRecession Odds, Bitcoin’s Future & NYC Mayor ElectionAnthony and John Pompliano break down today’s markets — from Scott Bessent’s U.S. outlook and Tom Lee’s bullish call to Jordi Visser’s take on Bitcoin’s “IPO moment.” They also cover job growth, mega themes, the New York City mayoral race, and Anthony’s latest thoughts on bitcoin and stocks.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

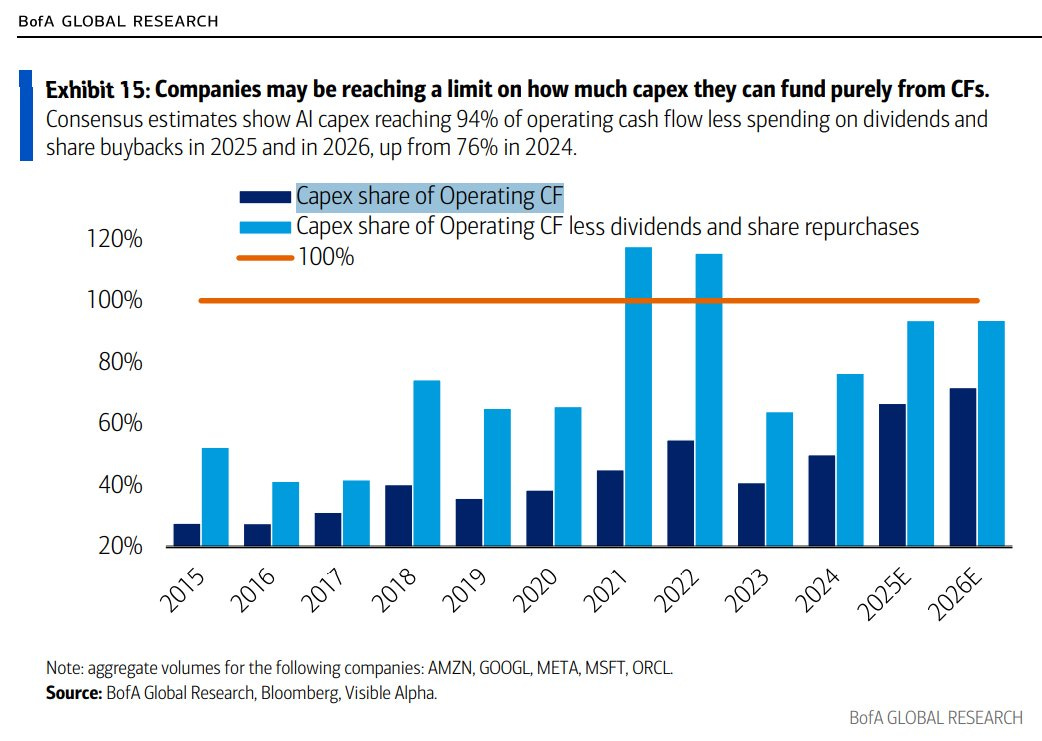

The AI Mega Deals Are Here & Stocks Will Keep Going Higher

Today’s letter is brought to you by MoonPay!Join over 30 million users who trust MoonPay as their universal crypto account.We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.Start now and get zero MoonPay fees1 on your first transaction.To investors,The stock market has been on a tear this year. The S&P 500 is up more than 16% and the Nasdaq has surged 23% higher year-to-date. This outperformance is largely attributed to the investment boom related to artificial intelligence.But one question lingers in the mind of every investor…are we in an AI bubble?The answer to that question will determine the portfolio returns of tens of millions of people. Before we discuss whether we are in a bubble or not, it is important to understand what is actually happening in the economy.The best description I have seen comes from Adam Kobeissi when he wrote about the AI construction boom:“The Dodge Momentum Index surged +60% YoY in September, to the highest on record. This index serves as a leading indicator of non-residential construction, tracking projects that typically move from planning to groundbreaking within 9–12 months. The jump was led by a +75% YoY spike in institutional projects such as healthcare and public buildings, and a +53% jump in commercial activity driven by data centers and retail. The index also rose +3% MoM in September, extending a powerful uptrend after +5% in August and +21% in July. In other words, the surge in AI-driven data center projects is set to translate into a powerful construction boom across the US in 2026. AI’s impact on the real economy is accelerating.”Goldman Sachs and Mike Zaccardi explain a big reason for this explosion is that mega-cap companies continue to exceed expectations on their AI CAPEX spending.So whether we are in a bubble or not, we know that companies are sinking insane amounts of money into building data centers and power generation. In fact, the investment in power generation is very important to pay attention to because the market is realizing that power, not chips, are the limiting factor for hyperscalers. Don’t take my word for it though. Here is Microsoft CEO Satya Nadella explaining the lack of power supply on a recent episode of the BG2 podcast:It is crazy to hear the CEO of a multi-trillion dollar company saying he has the compute capacity, but he doesn’t have the data centers and power supply to plug them into. This completely changes the way that investors will view the AI market.Strategist Shay Boloor explains:“The real constraint is not compute but power & data center space. This is exactly why access to powered data centers has become the new leverage point. If compute is easy to buy but power is hard to get, the leverage moves to whoever controls energy & infrastructure. Every new data center that $MSFT, $GOOGL, $AMZN, $META & $ORCL are trying to build needs hundreds of megawatts of steady power. Getting that energy online now takes years which means the players who locked in power early & built vertically across the stack are the ones with real control. Hyperscaler growth is no longer defined by how many GPUs they can buy but by how quickly they can energize new capacity.”Now Shay wrote this analysis before this morning’s mega announcements of energy deals with the hyperscalers. VanEck’s Matt Sigel points out “$15 billion in Bitcoin mining deals this morning. Sector market cap: ~$65 billion. Imagine if oil majors announced deals worth 20% of their market cap in one day. That’s how fast AI is rewiring the global energy stack.”The two deals this morning come from IREN and CIFR, two bitcoin mining businesses that are making the transition into AI data center providers. IREN announced a $9.7 billion AI cloud contract with Microsoft and CIFR announced a $5.5 billion deal with Amazon’s AWS.These mega deals prove the point that Satya Nadella was making. There is a significant supply-demand imbalance for data centers and energy production. You don’t have to be Albert Einstein to realize that the companies who solve this problem will create significant value for their shareholders.It is hard to have a bubble in AI when every person you talk to is yelling from the rooftop that demand is drastically outpacing supply. Bubbles only pop when a market gets saturated with supply and there are no buyers left. We are very, very far away from that moment. It doesn’t mean we won’t get there at some point in the future, but it does mean you can stop listening to the market crash predictors right now.Even the President of the United States believes “everybody wants AI because it’s the new internet. It’s the new everything. It’s one of the biggest things anyone’s ever seen. So everyone wants it. Yeah. I mean, the only problem is if you don’t get it.”It is hard to be bearish on a sector when the most powerful man in the world is actively creating policies that act as a tailwind for the industry.With that said, if I had to look at one aspect where risk can start to metastasize, it would be the use of leverage to fund CAPEX investments. We know that companies are reaching the limit of how much cash flow can be used for CAPEX investments. Mike Zaccardi shares a great chart to highlight where we are currently:Rohan Paul highlights the recent Bank of America research showing borrowing to fund AI data center spending has accelerated at a dizzying pace in September and October. Regardless of whether you are a bull or a bear on the AI bubble debate, no one is going to solve it. Only the market can do that. The market is the referee. And right now the market is telling us that AI companies are still undervalued compared to the value they will create by solving one of society’s hardest problems.Have a great start to your week. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementThe Truth About Why Bitcoin Isn’t Exploding (Yet)Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.In this conversation, we unpack the Fed’s interest rate cuts, the U.S.–China trade dynamic, and what they signal for global markets. We also dive into the Bitcoin, AI, and tokenized assets — explaining how these forces, alongside Tesla’s innovations, are shaping the next major investment cycle.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.1 Network, ecosystem, top-up and withdrawal fees may apply This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Markets Just Got The Green Light To Go Much Higher Through The End Of The Year

Join us at the 3rd Annual Bitcoin Investor Week!The 3rd annual Bitcoin Investor Week is returning to NYC on February 9th - 13th. This is the largest gathering of serious bitcoin investors in the world. 2,500+ people are expected this year.Speakers include Jan van Eck, Lyn Alden, Jeff Park, Anthony Scaramucci, Matt Cole, Caitlin Long, Dan Tapiero, Mark Yusko, Brandon Lutnick, Fred Thiel, and many others.TICKETS: https://bitcoininvestorweek.comTo investors,Uncertainty is a cancer that can spread fear through a market. It can kill optimism quickly because as the uncertainty mounts, the flow of capital slows and asset prices lose momentum. It is this loss of momentum that becomes dangerous to bull markets.Thankfully, we got extreme clarity yesterday on two major topics that investors care about: interest rates and our China trade relationship.First, Jerome Powell and the Federal Reserve cut interest rates 25 basis points during the conclusion of this week’s meeting. The decision was not a surprise, but some of Powell’s commentary around the decision was noteworthy.The Fed Chairman still believes there is potential risk to rising inflation, which frankly has failed to show up as he previously predicted, and he believes there is continued pressure on the labor market. His exact words were “risks to inflation are tilted to the upside, and risks to employment to the downside.”That is central banker speak for “we are watching the market but there is not explicit problem I can point to and scare you with at the moment.”At another point Jerome Powell was asked about the potential of a bubble in AI and the comparison to the 1999 tech boom. His answer was interesting:Business models. Revenue. Profits. You know, things that real companies have! This rational take from the leading central banker will hopefully quell some of the doomsday predictions of a massive bubble in AI.So the good news coming out of the Fed press conference yesterday is that rates were cut once again. The 25 basis points decrease brings cheaper capital into the market, incentivized more research and development in the corporate sector, and should result in asset prices continuing to go higher over the coming weeks.But the interest rate cut was not the only clarity we received yesterday.Last night we got word from President Trump’s visit to Asia that the United States has struck an agreement with China. This agreement is widely being reported as a tariff truce that is aimed at easing trade barriers the two countries have put on each other in recent months. Given the fact that tariffs were not fully removed, I don’t know if I would call it a truce. I would likely call this something more akin to a de-escalation when it comes to tariffs.Regardless of the specific wording, the important thing is that an agreement has been reached. Both the United States and China can claim victory in the outcome, which is an important component too.So what exactly was agreed to? Bloomberg explains the main components of this agreement include the US cutting tariffs on Chinese goods related to fentanyl down to 10%, China will buy a “tremendous amounts” of US soybeans and other farm goods, China will pause sweeping controls on rare earth exports, the US will roll back expansion of restrictions on Chinese companies, the US will extend a pause on some reciprocal tariffs for a year, and China will work with the US to resolve issues related to TikTok.It seems that both sides gave something in the negotiation, which is how a good deal gets done. Everyone has to walk away feeling like they could have gotten a slightly better deal. But the leaders of both countries seemed to be pleased with the meeting. Even President Trump described it as a 12 out of 10 and had many nice things to say about President Xi. This brings us back to how investors should perceive these events. It is nearly impossible to see interest rate cuts and a China agreement as a bearish catalyst that will lead to lower asset prices. The exact opposite is likely to happen. The United States is open for business and we have been running around the world striking trade deals that increase the amount of capital being invested in our country.Add in the fact that our central bank realizes they have to get the cost of capital down, which is why they continue to cut rates, and you have a clear picture of the ingredients needed for a bull run to continue. Clarity brings capital. Capital brings higher prices. Higher prices brings momentum. And momentum is really hard to stop once it gets going. The bull run is underway. The pessimists are wrong. This train won’t stop any time soon, so make sure you don’t poison your brain with fear porn.We are cleared for lift off. The next few weeks and months should be a lot of fun. Have a great day. I’ll talk to everyone tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWall Street Gives Credit Rating To Strategy For First TimeJeff Park is the Partner and Chief Investment Officer at ProCap BTC. In this conversation, we unpack why Strategy securing a credit rating marks a major milestone for Bitcoin adoption. Jeff breaks down what it means for corporate balance sheets, the upcoming Solana staking ETF, and how prediction markets are shaping global narratives — including the wild debate over whether Donald Trump might actually be Satoshi.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The DeFi Mullet Is Coming

Join us at the 3rd Annual Bitcoin Investor Week!The 3rd annual Bitcoin Investor Week is returning to NYC on February 9th - 13th. This is the largest gathering of serious bitcoin investors in the world. 2,500+ people are expected this year. Speakers include Jan van Eck, Lyn Alden, Jeff Park, Anthony Scaramucci, Matt Cole, Caitlin Long, Dan Tapiero, Mark Yusko, Brandon Lutnick, Fred Thiel, and many others.TICKETS: https://bitcoininvestorweek.comTo investors,I published a conversation with Coinbase’s Head of Consumer and Business Products yesterday. In the recording, Max Branzburg mentioned a “DeFi mullet,” which was described as the “easy Coinbase experience in the front and DeFi in the back.”This comment got me thinking about what is happening at the intersection of crypto and traditional finance. First, it is clear that “crypto” is not going to be a thing in a decade. Everything will be “finance” and you won’t know the difference between centralized or decentralized infrastructure.This is similar to what happened with the internet. There used to be internet companies and non-internet companies. People used to be considered cutting edge if they were using the internet, but now you would be deemed an idiot if you didn’t use the internet. The same thing is happening with crypto.Everyone from the new fintechs like Robinhood or the legacy firms like Blackrock are realizing they have to embrace this new technology in a variety of ways. No one calls Blackrock a bitcoin company and I don’t think many investors would consider Robinhood a crypto company. But those details don’t change the fact that each company is using this new technology to gain an advantage in the marketplace and better serve their customers.This decreasing importance of the “crypto” industry is a good sign. It means technology is becoming standard and expected. You can see the convergence happening perfectly with exchanges. Coinbase, Kraken, and many other crypto-native exchanges are racing to list public equities via tokenized securities. The fintechs like Robinhood, Public.com, eToro, and WeBull are quickly adding various crypto assets to their platform. Even ICE, CBOE, and Nasdaq are all finding various crypto products or companies to list on their exchanges.You aren’t going to have crypto and non-crypto exchanges. The end game is for exchanges to list public equities, crypto assets, and prediction markets all in one place. This is why Coinbase is publicly saying they want to be the “everything exchange,” while ICE is investing billions of dollars in prediction markets and crypto products.These firms are battling to be the future dominant venue for investors to buy and sell assets, regardless of their structure. The winner will capture tens of billions of dollars in profits. No wonder these exchanges are acting like they are in an all-out war for market share.But exchanges are not the only place this is happening.It seems like every day brings new headlines about stablecoins being adopted by the legacy finance players. Yesterday, we saw Coinbase announce a new partnership with Citi to “make on and off-ramping crypto easier for Citi’s institutional clients.” As part of the announcement, Coinbase CEO Brian Armstrong said “It’s not a debate anymore - crypto and stablecoins are the tools that will update the global financial system.”I think it is hard to argue with his logic at this point.Large financial institutions like Citi are not the only ones trying to create shareholder value by embracing stablecoins in the legacy system. Western Union says they are piloting stablecoin settlement rails to speed up cross-border payments and cut reliance on SWIFT.Their CEO Devin McGranahan says the company “sees stablecoins as an opportunity, not a threat.” That seems like a fair perspective to have, but the real question is whether these legacy companies will be able to move quickly enough to avoid disruption.Based on the fact that Western Union’s stock is down more than 50% over the last 5 years, it is more likely the market believes Western Union is going to be one of the carcasses left on the playing field by stablecoins and crypto-native payment rails.But here is the thing about stablecoins, right now you have to be a crypto-native to use these assets. You need to know what a wallet is. You need to know the difference between USDT, USDC, USDe, and many others. You have to understand how wallet addresses work, along with making technical decisions like which blockchain to leverage for your transaction.Normal people aren’t going to do any of that. They want to simply send, receive, and hold US dollars. This is where the “DeFi mullet” comes into play. The interface has to be familiar and trusted, while the infrastructure and plumbing can be completely upgraded.Victor Yaw has a great way to frame what is likely to happen. He writes “stablecoins will disappear into the plumbing of finance. Money will move across borders the way data moves across networks: instantly, programmatically, and without intermediaries noticing.”That sounds magical. Users get a better experience, while avoiding any requirement to learn new technologies. Add in the fact that large organizations like Blackrock, JPMorgan, Citi, Venmo, and PayPal will be offering these services and you can see why adoption is only going to become more pervasive over time.We have already seen bitcoin find success in the legacy system by companies putting the digital currency in traditional wrappers like ETFs or public companies. Now we will see similar things happen with stablecoins, but it won’t be ETFs and public companies. Rather it will be payment services and exchange platforms bringing this technology to users.The DeFi mullet is coming. The question is who will be the biggest winner? There is a trillion dollar reward waiting for whoever captures the opportunity.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy Coinbase Thinks Bitcoin & Crypto Will Replace Your BankMax Branzburg is the Head of Consumer Product at Coinbase, one of the most important companies in the crypto ecosystem. In this episode, we dive into how Coinbase is building the future of finance — from expanding bitcoin access to launching innovative products that bridge crypto and traditional markets. Max breaks down what’s driving Coinbase’s rapid product development, how they’re scaling to millions of users, and why the next wave of financial innovation will come from within crypto.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast