The Pomp Letter (private feed for doczok@zoho.com)

https://api.substack.com/feed/podcast/1383/private/db96a709-b2c2-4226-af09-d32883859066.rssEpisode List

The DeFi Mullet Is Coming

Join us at the 3rd Annual Bitcoin Investor Week!The 3rd annual Bitcoin Investor Week is returning to NYC on February 9th - 13th. This is the largest gathering of serious bitcoin investors in the world. 2,500+ people are expected this year. Speakers include Jan van Eck, Lyn Alden, Jeff Park, Anthony Scaramucci, Matt Cole, Caitlin Long, Dan Tapiero, Mark Yusko, Brandon Lutnick, Fred Thiel, and many others.TICKETS: https://bitcoininvestorweek.comTo investors,I published a conversation with Coinbase’s Head of Consumer and Business Products yesterday. In the recording, Max Branzburg mentioned a “DeFi mullet,” which was described as the “easy Coinbase experience in the front and DeFi in the back.”This comment got me thinking about what is happening at the intersection of crypto and traditional finance. First, it is clear that “crypto” is not going to be a thing in a decade. Everything will be “finance” and you won’t know the difference between centralized or decentralized infrastructure.This is similar to what happened with the internet. There used to be internet companies and non-internet companies. People used to be considered cutting edge if they were using the internet, but now you would be deemed an idiot if you didn’t use the internet. The same thing is happening with crypto.Everyone from the new fintechs like Robinhood or the legacy firms like Blackrock are realizing they have to embrace this new technology in a variety of ways. No one calls Blackrock a bitcoin company and I don’t think many investors would consider Robinhood a crypto company. But those details don’t change the fact that each company is using this new technology to gain an advantage in the marketplace and better serve their customers.This decreasing importance of the “crypto” industry is a good sign. It means technology is becoming standard and expected. You can see the convergence happening perfectly with exchanges. Coinbase, Kraken, and many other crypto-native exchanges are racing to list public equities via tokenized securities. The fintechs like Robinhood, Public.com, eToro, and WeBull are quickly adding various crypto assets to their platform. Even ICE, CBOE, and Nasdaq are all finding various crypto products or companies to list on their exchanges.You aren’t going to have crypto and non-crypto exchanges. The end game is for exchanges to list public equities, crypto assets, and prediction markets all in one place. This is why Coinbase is publicly saying they want to be the “everything exchange,” while ICE is investing billions of dollars in prediction markets and crypto products.These firms are battling to be the future dominant venue for investors to buy and sell assets, regardless of their structure. The winner will capture tens of billions of dollars in profits. No wonder these exchanges are acting like they are in an all-out war for market share.But exchanges are not the only place this is happening.It seems like every day brings new headlines about stablecoins being adopted by the legacy finance players. Yesterday, we saw Coinbase announce a new partnership with Citi to “make on and off-ramping crypto easier for Citi’s institutional clients.” As part of the announcement, Coinbase CEO Brian Armstrong said “It’s not a debate anymore - crypto and stablecoins are the tools that will update the global financial system.”I think it is hard to argue with his logic at this point.Large financial institutions like Citi are not the only ones trying to create shareholder value by embracing stablecoins in the legacy system. Western Union says they are piloting stablecoin settlement rails to speed up cross-border payments and cut reliance on SWIFT.Their CEO Devin McGranahan says the company “sees stablecoins as an opportunity, not a threat.” That seems like a fair perspective to have, but the real question is whether these legacy companies will be able to move quickly enough to avoid disruption.Based on the fact that Western Union’s stock is down more than 50% over the last 5 years, it is more likely the market believes Western Union is going to be one of the carcasses left on the playing field by stablecoins and crypto-native payment rails.But here is the thing about stablecoins, right now you have to be a crypto-native to use these assets. You need to know what a wallet is. You need to know the difference between USDT, USDC, USDe, and many others. You have to understand how wallet addresses work, along with making technical decisions like which blockchain to leverage for your transaction.Normal people aren’t going to do any of that. They want to simply send, receive, and hold US dollars. This is where the “DeFi mullet” comes into play. The interface has to be familiar and trusted, while the infrastructure and plumbing can be completely upgraded.Victor Yaw has a great way to frame what is likely to happen. He writes “stablecoins will disappear into the plumbing of finance. Money will move across borders the way data moves across networks: instantly, programmatically, and without intermediaries noticing.”That sounds magical. Users get a better experience, while avoiding any requirement to learn new technologies. Add in the fact that large organizations like Blackrock, JPMorgan, Citi, Venmo, and PayPal will be offering these services and you can see why adoption is only going to become more pervasive over time.We have already seen bitcoin find success in the legacy system by companies putting the digital currency in traditional wrappers like ETFs or public companies. Now we will see similar things happen with stablecoins, but it won’t be ETFs and public companies. Rather it will be payment services and exchange platforms bringing this technology to users.The DeFi mullet is coming. The question is who will be the biggest winner? There is a trillion dollar reward waiting for whoever captures the opportunity.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy Coinbase Thinks Bitcoin & Crypto Will Replace Your BankMax Branzburg is the Head of Consumer Product at Coinbase, one of the most important companies in the crypto ecosystem. In this episode, we dive into how Coinbase is building the future of finance — from expanding bitcoin access to launching innovative products that bridge crypto and traditional markets. Max breaks down what’s driving Coinbase’s rapid product development, how they’re scaling to millions of users, and why the next wave of financial innovation will come from within crypto.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

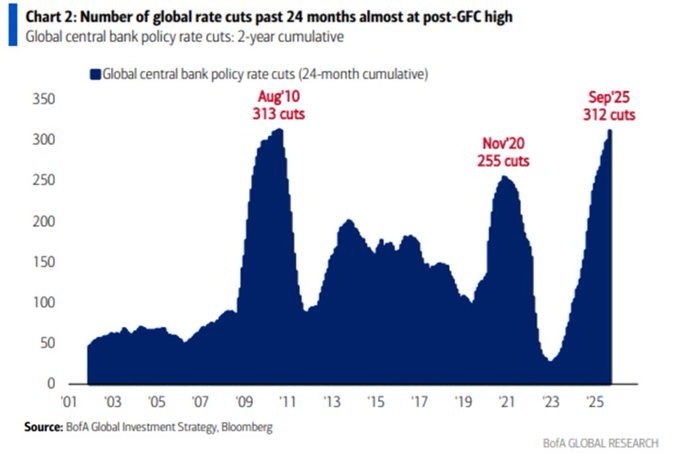

China Trade Deal And Rate Cuts Will Send Markets Higher

You’re invited to ResiDay 2025, a conference for today’s top leaders in residential real estate.Join myself and ResiClub Founder Lance Lambert on Friday, November 7th in New York City for a one-day conference bringing together the housing market’s top investors, developers, builders, lenders, and brokers. Expect top-tier speakers, networking with industry leaders, and data-driven conversation around the next decade of housing.Speakers highlights include…* Bill Pulte, Director, FHFA (Virtual)* Sean Dobson, Founder & CEO, Amherst* Jim Jacobi, President, Parkland Communities* Kaz Nejatian, CEO, OpenDoor (Virtual)* Raunaq Singh, Founder & CEO, Roam* Allan Merrill, Chairman & CEO, Beazer Homes* John Rogers, Chief Data & Analytics Officer, CotalityTickets are limited, secure your spot here: https://luma.com/ResiDay2025To investors,Asset prices love responding to market catalysts. Sometimes catalysts are telegraphed and other times they come as a surprise. Take the Federal Reserve’s planned meeting on Tuesday and Wednesday this week.Every investor knows it is coming. It has been marked on calendars all year. Most investors expect the central bank to cut interest rates. In fact, Polymarket is currently showing a 98% chance of a 25 basis point cut.Asset prices like cheaper capital because investors push further out on the risk curve. Lower rates signal a continued tailwind for stocks and bitcoin. And it is not just the Federal Reserve’s monetary policy decisions that matter in this regard.Bitwise’s André Dragosch writes “the number of global rate cuts [in the] past 24 months is already higher than after Covid but bears still think bitcoin has already peaked.”It is crazy to see 312 interest rate cuts around the world over the last 24 months when you realize the Fed’s interest rate is still set at 4% or higher. There is a lot of room to go for America’s central bank to bring rates back down to 1-2%.But the interest rate cuts this week are only part of the story. Everyone knows those cuts are coming, but what we didn’t know until this weekend was how likely a US-China trade deal was.Treasury Secretary Scott Bessent did the media rounds Sunday morning and wanted to make sure the world knew a trade deal is coming. Bloomberg writes:“Top trade negotiators for the US and China said they came to terms on a range of contentious points, setting the table for leaders Donald Trump and Xi Jinping to finalize a deal and ease trade tensions that have rattled global markets.After two days of talks in Malaysia wrapped up Sunday, a Chinese official said the two sides reached a preliminary consensus on topics including export controls, fentanyl and shipping levies.US Treasury Secretary Scott Bessent, speaking later in an interview with CBS News, said Trump’s threat of 100% tariffs on Chinese goods “is effectively off the table” and he expected the Asian nation to make “substantial” soybean purchases as well as offer a deferral on sweeping rare earth controls. The US wouldn’t change its export controls directed at China, he added.”So what should we expect to happen if the US-China trade deal gets announced? Jordi Visser explains how bullish it should be for stocks and bitcoin:Investors like certainty. They want predictability. If they get clarity in the US-China trade negotiations, markets are going to take off higher. Don’t believe me? Scott Bessent’s commentary from the weekend has already sent stocks and bitcoin inching higher as investors anticipate the big trade deal confirmation.See here is the thing people don’t want to admit: the world operates in the middle of extreme positions. It is true that US and China are locked in economic competition. They both wish they could decouple. But that is not reality. These two countries depend on each other. So the trade deal is going to get done.And markets know this. The market also knows rates are going to come down and the government will never stop printing money. Each of these three things are bullish for stocks and bitcoin.But I do have one surprise for you. Gold’s explosive move in the last few months probably signals we are unlikely to see further price appreciation through the end of the year. In fact, we are already seeing gold sell off over the last two weeks and I think that could continue for the rest of 2025.In that scenario, Bizyugo points out the bitcoin mania started in 2020 when gold peaked. There is no guarantee we will see a repeat of 2020, but the macro environment is setting us up almost perfectly. I would be surprised if bitcoin didn’t run into the end of the year. And stocks will be side-by-side the digital currency.The S&P 500, Dow and Nasdaq are all at record highs. Things in motion stay in motion. And I am guessing the party is just getting started. Hope everyone has a great start to your week. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementProof That Bitcoin & AI Are Going Much HigherJordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation, we cover Tesla’s robo-taxis, inflation, interest rates, and the U.S.–China trade dynamic. Jordi also shares how he’s positioning his portfolio, and what Bitcoin, gold, and market psychology reveal about where investors are headed next.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.* Zkverify - A modular blockchain dedicated to efficiently verifying zk proofs across diverse blockchain stacks.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

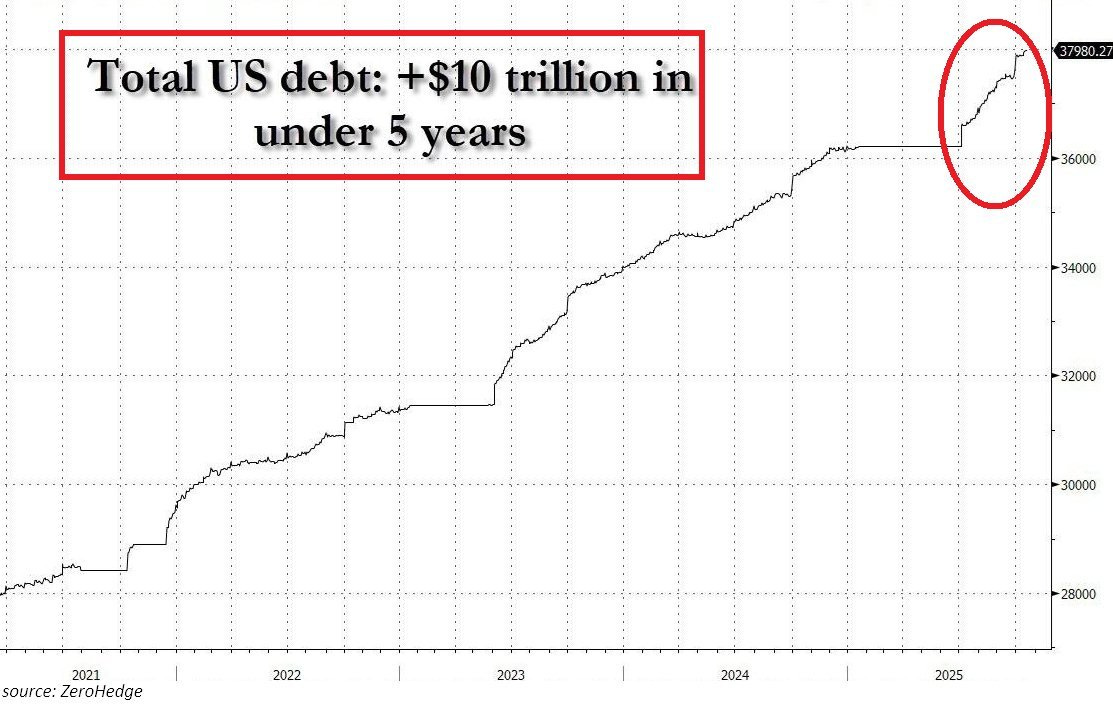

The National Debt Just Hit A New Record High And Our Children Will Pay The Bill

Today’s Letter is brought to you by Arch Public!Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.Talk to us today and discover why our expertise sets us apart.To investors,The United States of America is the first to do a lot of things. We were the first to write and ratify a Constitution. We were first to put a human in space. We were the first to land on the moon. We were the first to create a commercial nuclear power plant. We were the first to ratify important amendments on human rights like free speech and due process.And this week America added a new “first” to our resume. The US national debt just crossed $38 trillion, which makes us the first country in human history to have accumulated this much debt.Adam Kobeissi writes “Total US debt officially crosses above $38 trillion for the first time in history. This marks a +$500 BILLION jump this month, or +$23 billion per day.”Give yourself a round of applause everyone.Oh wait, this isn’t a milestone we should be celebrating. In fact, we should be appalled that our country’s leadership has lacked the financial discipline to avoid this scenario.A big driver of the catastrophic destiny we have been pre-ordained to is our addiction to money printing. Jesse Myers writes “The money printer hasn’t run this hot since COVID. Global M2 money supply now ~$137 trillion. It was $129 trillion just 6 months ago.”Lawrence Lepard points out “12% annualized growth rate in global M2. Far cry from the Fed’s 2% target and they haven’t really even turned on the printer yet.”I don’t see the national debt problem going away in my lifetime. This means the currency will be debased to avoid default, so our politicians on both sides of the aisle are essentially sticking our children with the bill.It is a horrible, no good situation. The only thing I know to do is opt-out of the broken system with some portion of my economic value. The higher the national debt goes, the higher bitcoin will go. And it doesn’t appear either of them will stop any time soon.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementWhy The Bitcoin Bull Market Is Not Over With Jeff ParkJeff Park is a Partner and Chief Investment Officer at ProCap BTC. In this episode, we unpack why Bitcoin isn’t the bubble — it’s the pin. Jeff breaks down the rotation from gold into Bitcoin, how whales are contributing spot BTC to ETFs, and what Coinbase’s acquisition of Echo signals for both retail and institutional investors.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

The Economic Data Is Politically Biased And I Have Proof

Today’s Letter Is Brought To You By A Golden Visa for the Bitcoin-Forward Investor!Bitizenship helps Bitcoiners secure EU residency and a path to Portuguese citizenship, without abandoning their long-term thesis.Bitizenship Helps You:✔ Unlock visa-free travel across Europe✔ Secure residency with minimal physical presence✔ Maintain Bitcoin exposure through a regulated structure✔ Set up a future-proof Plan B for your family✔ Gain one of the world’s strongest passports in 5 yearsTime-Sensitive Update: Portugal may pass new citizenship rules within the near future, doubling the timeline to 10 years.Lucky for you, there’s time to lock in the current law if you act now.To investors,The finance industry runs on economic data. Investors around the world consume various data points, draw conclusions from the data, and make capital allocation decisions based on that data.But what if the data being consumed by investors is inaccurate? What if the data is politically biased?It would essentially guarantee misguided investment decisions are being made. Bad inputs lead to bad outputs. You can’t make good decisions if you are basing those decisions on inaccurate or biased data.This brings us to a bombshell discovery of provably false and politically biased data by Fundstrat and Tom Lee. In a recent report to clients, Fundstrat pointed out how the University of Michigan consumer survey has become completely unreliable due to a sharp rise in political bias.Before I cover that bias and inaccuracy, let me explain the University of Michigan survey. The survey is described as “a monthly survey that measures American consumers’ attitudes toward the economy, personal finances, and their readiness to spend. Considered a leading economic indicator, the survey, which has been conducted since 1946, uses a minimum of 500 phone interviews and provides insights into consumer optimism or pessimism. The results are used to predict economic trends, including consumer spending and the overall health of the economy.”Now lets go back to the political bias and inaccuracies. We have known for awhile there are differences in political affiliations when it comes to inflation expectations. Fundstrat shows that here:Democrats expect inflation to be 5.3% a year from now, while Republicans believe it will be 1.5%. Of course, the truth is likely somewhere in-between. But this political difference is not a problem because it is clear, transparent, and easily understood. You can summarize the difference as politics breaking the economic brains of those being surveyed.Is it dumb? Of course. Would I accuse the University of Michigan of tipping the scales in any way? No, not at all. But Fundstrat takes their analysis a step further. They show that the University of Michigan survey has been corrupted over the last two years. They used to survey Republicans and Democrats on a 50/50 basis for years, but there was an explicit change in early 2024.The University of Michigan survey has shifted left on the political aisle. Rather than 50/50 survey pool, the surveyed group is now 65% Democrats and the trend is only getting worse. You can see in the chart how absurd the change has been.So what is the big deal?If I am being nice, the University of Michigan has suddenly screwed up their data collection methodologies. Frankly, I find that hard to believe given how well they stayed unbiased for years. If I put on my conspiratorial hat, we need to ask why University of Michigan is manipulating the data and putting their fingers on the scale?I will leave it to each of you to decide whether you think the data issues are intentional or not.And to provide the most robust analysis possible, here is a 4-minute clip of Tom Lee talking with me about this ridiculous issue:The economic data is corrupted. It is politicaly biased. If you are counting on that data to make investment decisions, it is going to be very hard to make good investment decisions moving forward.I am looking at ways to address this issue for myself and our investing activities. As I find solutions, I will share them with all of you.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementGold Is Winning But Bitcoin Will Win BiggerAnthony and John Pompliano discuss everything happening across the markets — bitcoin, gold, stocks, the Fed, and where things could be headed next. Are we going up or down? Should investors be worried or getting excited? And why retail investors might actually have an edge over institutions right now.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

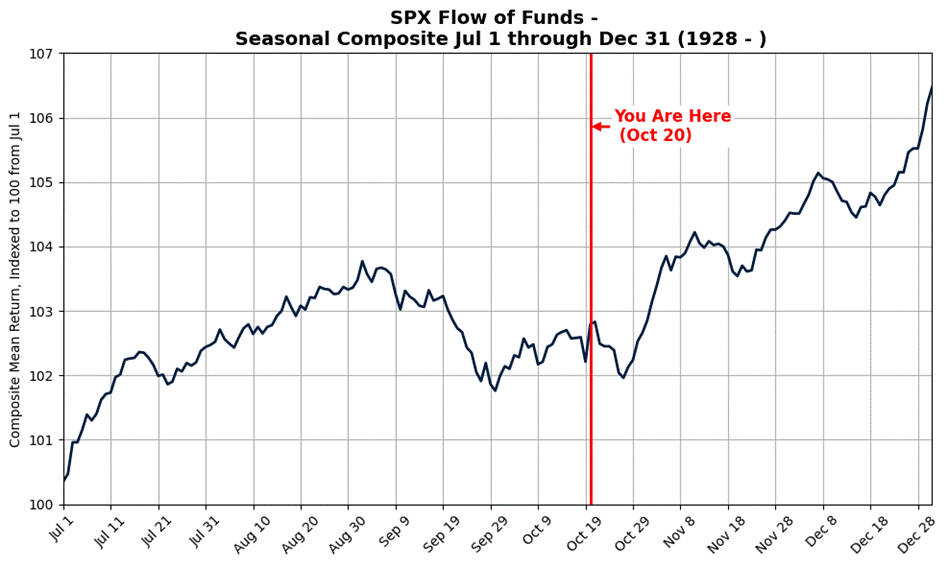

Risk Assets and Safe Haven Assets Push Higher Together?!

Today’s Letter is brought to you by Arch Public!Unlock unparalleled returns with Arch Public’s algorithmic trading tools. Our Bitcoin Algorithm Arbitrage Strategy has delivered an astounding 247% annual return over the past three years.The entries, and exits speak for themselves; precision that drives success. Trusted by more than 15,000 customers and industry leaders, we’ve partnered with Gemini, Kraken, Coinbase and Robinhood to bring you cutting-edge solutions.Whether you’re a seasoned investor or just starting, our proven strategies maximize your potential. Join the ranks of those who trust Arch Public to navigate the markets with confidence.Talk to us today and discover why our expertise sets us apart.To Investors,Peter Lynch is one of the greatest investors to ever live. While at Fidelity Investments, he averaged a 29% return and managed the best performing mutual fund in the world. So it is noteworthy that one of his most famous quotes is “if you spend 13 minutes a year on economics, you have wasted 10 minutes.”Pretty good one-liner, right?The reason Lynch believed macro economics was noise is because he managed money during a time where everyone was constantly worried about monetary policy, geopolitics, and various topics outside financial markets. His strategy was simply to buy shares in great companies and wait for the companies to increase in value.It wasn’t rocket science. But here is the thing, the stock market has significantly changed over the last 50 years. We went from a market where ignoring macro economics increased your likelihood of success to the modern market where paying attention to macro economics is all that matters.Let me give you an example. Former Pimco CEO Mohammed El-Erian wrote yesterday “Forgive me for sounding like a broken record, but today’s market action is so illustrative of something I’ve been trying to convey for a while now. The notable thing about gold today isn’t just that its price hit yet another record high, but how it has done so: Gold is surging on the same day that US stock indices have over 1%. This simultaneous climb in both a classic safe haven and risk assets is a powerful illustration that the drivers of the current gold rally are different from historical patterns.”Safe haven assets and risk assets are both pushing higher at the same time. That isn’t supposed to happen. It violates everything an investor was taught in their Economics 101 class. So what is going on here?Holger Zschaepitz explains the different sides of the debate:“Despite the Nasdaq 100 hitting a new all-time high, market sentiment remains unusually split, a divide also reflected in Bitcoin’s wild swings. Goldman Sachs sees two ways to read this: Cynics view it as a fragile equilibrium, where even a small shock could end the rally. Optimists see it as the hallmark of a healthy bull market – one that keeps climbing the proverbial wall of worry.”So who is right? Should we be worried about the concurrent rise of risk assets and safe haven assets? Well, let’s turn back to Peter Lynch.He once said “I’ve studied the Constitution and the Bill of Rights, and I don’t see anywhere that we have to have a recession every four years. I don’t see why you can’t have a decent environment for years and years.”Spoken like a true optimist if you ask me.My personal opinion on why all asset prices are going higher boils down to the macro environment. Markets are forward-looking and everyone has become convinced that the government won’t stop printing money, the national debt is going to continue accelerating higher, the Federal Reserve and central banks around the world have to cut interest rates in the coming months, and artificial intelligence is making companies more profitable with less employees.Those four factors are causing investors to pour capital into almost all asset classes. They understand holding cash and bonds will likely be a losing trade. You can buy stocks, bitcoin, gold, real estate, or collectibles. The micro decisions are not nearly as important as the big decision to convert fiat dollars into some kind of investment asset.People are not going to wait around for the currency debasement and persistently high inflation to wreck their portfolio. They are positioning themselves to benefit from the pain on the horizon.Add in the fact that we are sitting in the middle of October, which means the year end chase is underway, and it becomes obvious that the bull market is not ending this month.Risk assets and safe haven assets are going to continue performing. In this environment, some investors want to play offense and some want to play defense. But the number of market participants has expanded so rapidly that now there is enough capital for both types of assets to appreciate as money sloshes around the system.Price appreciation won’t be a straight line to the sky. There will be corrections along the way. But as Peter Lynch advised us, “in the stock market, the most important organ is the stomach. It’s not the brain.” So keep your head on a swivel and understand the macro environment went from something you could ignore in the past to potentially the only thing that matters today.Hope everyone has a great day. I’ll talk to you tomorrow.- Anthony PomplianoFounder & CEO, Professional Capital ManagementThis Executive Thinks Bitcoin Will Hit $180,000 By Year EndChris Klein is the Co-Founder & CEO of Bitcoin IRA (https://bitcoinira.com/pomp/). In this conversation, we discuss how retirement investing is changing in the digital era, what people are actually doing inside their retirement accounts, and how the wealthy use these tools to grow their wealth faster. We also dive into broader topics like patriotism in America, macro trends, and the roles of gold, silver, stocks, and Bitcoin in today’s economy.Enjoy!Podcast Sponsors* Figure – Lowest industry interest rates at 8.91% at 50% LTV and 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin or SOL. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.* Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)* Defi Development Corp - DeFi Development Corp. (Nasdaq: DFDV) is building the first Solana-focused public treasury, giving investors exponential exposure to Solana’s growth.* easyBitcoin - Stack sats with easyBitcoin.app—earn 1% extra on buys, 2% annual rewards and 4.5% APY on USD. Download it at easybitcoin.app today.* Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs* Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.* Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com* Xapo Bank: Fully licensed private bank and virtual assets services provider that integrates traditional finance and Bitcoin. Earn up to 3.6% in BTC over USD Savings. Spend globally with a debit card that gives up to 1% cashback in BTC. The Pomp Audience Exclusive: Receive $150 discount when they join with this link.* Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.* Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.* BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this form and someone from our team will get in touch with you.You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. This is a public episode. If you'd like to discuss this with other subscribers or get access to bonus episodes, visit pomp.substack.com/subscribe

Create Your Podcast In Minutes

- Full-featured podcast site

- Unlimited storage and bandwidth

- Comprehensive podcast stats

- Distribute to Apple Podcasts, Spotify, and more

- Make money with your podcast